India’s Defence Budget 2015-16

- March 02, 2015 |

- Issue Brief

[W]e need a vast pool of highly skilled and qualified human resources for the defence industry. Our aerospace industry alone would need about 200,000 people in another ten years. We will set up special universities and skill development centres to cater to our defence industry, just as we have done in atomic energy and space… We must ensure that our tax system does not discriminate against domestic manufacture in comparison to imports.

… Prime Minister Narendra Modi, in his address at Aero India on February 18, 2015

Introduction

The first full budget of the Modi government presented to Parliament on February 28, 2015 set aside Rs. 2,46,727 crore (US$ 40.4 billion) for defence, which amounts to a 7.7 per cent increase over the previous year’s allocation. The defence allocation is, however, exclusive of another Rs. 62,852.6 crore provided to the Ministry of Defence (MoD) under the heads of Defence Pensions (Rs. 54,500 crore) and Civil Expenditure of MoD (Rs. 8,852.6 crore), both of which do not form part of India’s official defence budget. The latest defence allocation comes in the wake of the Modi government’s all-out push for the ‘Make in India’ initiative, the ‘heart’ of which, as noted by the Prime Minister himself at the Aero India 2015, is the defence industry. The budget also comes in the wake of the government’s acceptance and implementation of the report of the 14th Finance Commission, which has made a number of recommendations that have a bearing on the central government’s budget, a significant portion of which is spent on defence. This Issue Brief examines the 2015-16 defence budget keeping in view these two developments in particular. But it begins with a macro survey of the Indian economy and the central government’s fiscal situation, both of which have a direct bearing on defence.

The first full budget of the Modi government presented to Parliament on February 28, 2015 set aside Rs. 2,46,727 crore (US$ 40.4 billion) for defence, which amounts to a 7.7 per cent increase over the previous year’s allocation. The defence allocation is, however, exclusive of another Rs. 62,852.6 crore provided to the Ministry of Defence (MoD) under the heads of Defence Pensions (Rs. 54,500 crore) and Civil Expenditure of MoD (Rs. 8,852.6 crore), both of which do not form part of India’s official defence budget. The latest defence allocation comes in the wake of the Modi government’s all-out push for the ‘Make in India’ initiative, the ‘heart’ of which, as noted by the Prime Minister himself at the Aero India 2015, is the defence industry. The budget also comes in the wake of the government’s acceptance and implementation of the report of the 14th Finance Commission, which has made a number of recommendations that have a bearing on the central government’s budget, a significant portion of which is spent on defence. This Issue Brief examines the 2015-16 defence budget keeping in view these two developments in particular. But it begins with a macro survey of the Indian economy and the central government’s fiscal situation, both of which have a direct bearing on defence.

State of the Economy

The 2015-16 defence budget comes in the backdrop of some visible improvements in key indicators of the Indian economy. As the Economy Survey 2014-15 brings out, the real gross domestic product (GDP), as expressed through the recently revised methodology for estimating national income by the Central Statistics Office (CSO), is expected to grow by between 8.1 and 8.5 per cent in 2015-16, as against 7.4 per cent in the preceding year. The improvement in the GDP figure also coincides with a sharp decline in international commodity prices (particularly of crude oil). This has had a helpful impact on inflation and the fiscal deficit, the latter being projected to decline to 3.9 per cent of GDP in 2015-16 from 4.1 per cent in the previous year. On India’s external front, there has also been several impressive improvements as witnessed in the surge in the country’s foreign exchange reserves, stability in the rupee-dollar exchange rate, and a sharp narrowing of the Current Account Deficit (CAD) which had deteriorated to a ‘worryingly high’ level not so long ago, causing panic among investors and an outflow of foreign exchange.

Notwithstanding the improvement in the aforementioned indicators, the revenue collection of the government still remains subdued, reflecting the painful recovery process that the economy is still going through. According to estimates, the central government’s gross tax revenue collection is projected to grow by only six per cent to Rs. 14,49,490 crore in 2015-16. More importantly, unlike in 2014-15, a greater part of the centre’s gross tax revenue in 2015-16 would be devolved to states as part of the implementation of 14th Finance Commission report, which had recommended that the states’ share in the divisible pool of Union taxes be increased by 10 percentage points to 42 per cent. Consequently, the central government is left with proportionately lesser resources. In fact, the central government’s total net tax revenue (after deducting the states’ share) has gone down by six per cent to Rs. 9,19,842 crore, causing a further cascading effect on total central government expenditure (CGE), which has been reduced by nearly one per cent to Rs. 17,77,477 crore in 2015-16.

The eight per cent growth in the defence budget has to be seen in the light of this development, although there would be plenty of disappointment for the armed forces which would have expected a double digit growth. This disappointment is mainly due to the ever widening gap between the resource requirement projected by the Ministry of Defence and what it is finally allotted in successive budgets. Suffice to mention that the gap, which was eight per cent (Rs. 12,453 crore) in 2009-10 increased to a mammoth 26 per cent (Rs.79,363 crore) in 2014-15 (Figure I). It can be assumed with a reasonable degree of certainty that the gap, both in percentage and absolute terms, would have further increased in 2015-16.

Figure I. Widening Gap between MoD’s Resource Projection and Allocation

Defence Budget: Estimates, Major Elements and Growth Drivers

It is to be noted that though the defence budget for 2015-16 has grown by eight per cent over the preceding year’s budget allocation, the growth rate amounts to 11 per cent over the revised allocation for 2014-15. This means that the original budget allocation of 2014-15 has been revised downward, to the extent of Rs. 6,630 crore, or three per cent of the total. The downward revision was on account of the reduction in capital expenditure by Rs. 12,623 crore (13 per cent). More significantly, nearly 72 per cent (Rs. 9,123 crore) of the total cut in capital expenditure was effected on the capital acquisition budget. On the other hand, the revenue expenditure was revised upward by Rs. 5,993 crore (four per cent) (see Table I).

Table I. Budget and Revised Estimates for 2014-15 and 2015-16

| Revenue Expenditure (Rs. in crore) | Capital Expenditure (Rs. in Crore) | Total (Rs. in Crore) | |

| 2014-15 (BE) | 134412.1 | 94588.0 | 229000.0 |

| 2014-15 (RE) | 140404.8 | 81965.2 | 222370.0 |

| 2015-16 (BE) | 152139.0 | 94588.0 | 246727.0 |

Note: BE: Budget Estimate; RE: Revised Estimate

Table II summarises the key elements of the defence budgets of 2014-15 and 2015-16. Of note here is the decline in the share of capital expenditure in the total defence budget to below 40 per cent. The last time the share of capital expenditure went below 40 per cent was in 2009-10 when the hike in pay and allowances due to the implementation of the Sixth Central Pay Commission recommendations increased the share of revenue expenditure to over 60 per cent. In 2015-16 also, it is the same pay and allowances that have resulted in a similar situation. It is to be noted that of the total increase of Rs. 17,727 crore in the defence budget of 2015-16, Rs. 8,855 crore (50 per cent) is on account of increase in pay and allowances of the three armed services. Compared to this, the ‘Stores’ budget, which is key to maintenance and hence preparedness, has contributed only 17 per cent to the growth of the defence budget. Capital expenditure, which is key to acquiring new capability, has not contributed anything to this growth as the allocation remains virtually the same as last year.

An interesting feature of Table II is the movement in different directions of the share of defence in GDP and CGE. While the share of defence in GDP has decreased marginally, that of CGE has increased by more than one percentage point. The decrease in the share of GDP is primarily due to relatively subdued growth in defence expenditure vis-à-vis the growth rate of GDP, which is projected to increase by 11.5 per cent in nominal terms. On the other hand, the increase in the share of CGE is due to the shrinking of the total government expenditure due to the greater devolution of tax revenue to the states.

Table II: Comparative Statistics of Defence Budget: 2014-15 and 2015-16

| 2014-15 | 2015-16 | |

| Defence Budget (Rs. in Crore) | 229000.0 | 246727.0 |

| Growth of Defence Budget (%) | 12.4 | 7.74 |

| Revenue Expenditure (Rs. in Crore) | 134412.05 | 152139.0 |

| Growth of Revenue Expenditure (%) | 14.9 | 13.2 |

| Share of Revenue Expenditure in Defence Budget (%) | 58.7 | 61.7 |

| Capital Expenditure (Rs. in Crore) | 94587.95 | 94588.0 |

| Growth of Capital Expenditure (%) | 9.0 | 0.0 |

| Share of Capital Expenditure in Defence Budget (%) | 41.3 | 38.3 |

| Capital Acquisition (Rs. in Crore) | 75148.03 | 77704* |

| Growth of Capital Acquisition (%) | 2.3 | 3.4* |

| Share of Defence Budget in GDP (%) | 1.81 | 1.75 |

| Share of Defence Budget in Central Government Expenditure (%) | 12.8 | 13.9 |

Note: *: approximate figure. Rs. 1.0 crore = Rs. 10 million = US$ 163,880 (as per the average exchange rate for the first 11 months of 2014-15)

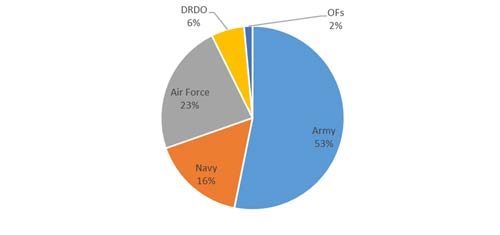

Share of the Three Services

Like in the past, the Army continues to be biggest stakeholder in the defence budget. With an approximate allocation of Rs. 1,30,874 crore, it accounts for 53 per cent of the total defence budget in 2015-16. The Air Force comes a distant second with an allocation of Rs. 56,658 crore, followed by the Navy (Rs. 40,529 crore), Defence Research and Development Organisation (Rs. 14,358 crore) and Ordnance Factories (Rs. 3,644 crore) (see Figure II). It is to be noted, however, that the Army is the most revenue-intensive service. In 2015-16, 80 per cent of its budget has been earmarked for revenue expenditure. The corresponding figures for the Navy and Air force are 38 and 41 per cent, respectively.

Figure II. Share of Defence Services in Defence Budget 2015-16

Impact on Capital Acquisition

One area where the 2015-16 defence budget is likely to hurt the most is in capital acquisition, which has already been under acute pressure in recent years due to the overwhelming share of the ‘committed liabilities’ arising out of contracts already signed (see Table III). Given the already downward revision of the 2014-15 capital acquisition budget, its moderate increase in the 2015-16 budget is unlikely to generate the required money to sign any major new contracts. Tables IV, V and VI summarise the capital acquisition budget of the three services. Among the three, the Air Force’s budget is projected to decline, albeit marginally. This comes at a time when it has lined up several mega deals which are one step short of contract signing. These include the tanker aircraft deal with Airbus, two helicopter contracts with Boeing and the Rafale fighter deal with Dassault Aviation. For the Rafale deal alone, the initial payment is estimated at Rs. 15,000 crore, which is almost half of what has been provided in the Air Force’s latest acquisition budget. So the writing on the wall is very clear. Unless the acquisition budget, particularly that of the Air Force, is substantially augmented during the course of 2015-16, there is a little chance of these deals being signed.

Table III. Share of Committed Liabilities and New Schemes in Capital Acquisition Budget

| Committed Liabilities (Rs. in Cr) | New Schemes (Rs. in Cr) | |||

| Rs. in Crore | % of Total Acquisition Budget | Rs. in Crore | % of Total Acquisition Budget | |

| 2013-14 (BE) | 70489 | 96 | 2956 | 4 |

| 2014-15 (BE) | 69746 | 93 | 5402 | 7 |

Note: BE: Budget Estimate

Table IV. Army’s Acquisition Budget

| 2014-15 (BE) (Rs in Cr) | 2014-15 (RE) (Rs in Cr) | 2015-16 (BE) (Rs in Cr) | % Increase in 2015-16 (BE) over 2014-15 (BE) | |

| Aircraft & Aero-Engine | 2128.0 | 2323.6 | 2365.4 | 11.2 |

| H&MV | 2692.2 | 1783.6 | 1783.8 | -33.7 |

| Other Equipment | 15591.9 | 12548.8 | 17335.2 | 11.2 |

| Rolling Stock | 275.1 | 60.7 | 364.0 | 32.3 |

| Rashtriya Rifles | 213.1 | 210.6 | 91.0 | -57.3 |

| Total Acquisition Budget | 20900.2 | 16927.4 | 21939.4 | 5.0 |

Table V. Navy’s Acquisition Budget

| 2014-15 (BE) (Rs in Cr) | 2014-15 (RE) (Rs in Cr) | 2015-16 (BE) (Rs in Cr) | % Increase in 2015-16 (BE) over 2014-15 (BE) | |

| Aircraft & Aero-Engine | 3330.7 | 3310.7 | 3466.1 | 4.1 |

| H&MV | 34.3 | 8.0 | 11.0 | -67.9 |

| Other Equipment | 4358.1 | 3696.9 | 2558.6 | -41.3 |

| Joint Staff | 1028.9 | 714.8 | 922.3 | -10.4 |

| Naval Fleet | 12576.1 | 9398.3 | 16049.9 | 27.6 |

| Naval Dockyard | 1612.9 | 661.3 | 1275.3 | -20.9 |

| Total Acquisition Budget | 22940.9 | 17790.1 | 24283.2 | 5.9 |

Table VI. Air Force’s Acquisition Budget

| 2014-15 (BE) (Rs in Cr) | 2014-15 (RE) (Rs in Cr) | 2015-16 (BE) (Rs in Cr) | % Increase in 2015-16 (BE) over 2014-15 (BE) | |

| Aircraft & Aero-Engine | 16271.4 | 21461.4 | 18866.0 | 15.9 |

| H&MV | 194.3 | 67.0 | 233.4 | 20.1 |

| Other Equipment | 15352.2 | 10289.5 | 12382.1 | -19.3 |

| Total Acquisition Budget | 31817.9 | 31817.9 | 31481.5 | -1.1 |

‘Make in India’ for Defence

Rising up to the huge expectation generated since the launch of ‘Make in India’ initiative in September 2014, the Union Budget has made a number of provisions to incentivise Indian industry, particularly the manufacturing sector. Among others, the budget has proposed to reduce the corporate tax from 30 to 25 per cent over a period of four years in a move to: bring parity with the tax structure of other manufacturing nations; enhance the access of technology to small businesses by reducing the rate of income tax on royalty and fees for technical services from 25 to 10 per cent; and explore the possibility of replacing the system of multiple prior permissions required for setting up a business with a pre-existing regulatory mechanism so as to further improve the ‘ease of doing business’.

It is to be noted, however, that while the aforementioned measures are likely to help defence manufacturing in some way, they may not prove sufficient. To boost indigenous arms manufacturing, particularly by the private sector, there is a need for huge investment in plant and machinery, technology and skill development. At the same time, tax and duties structure also need to be made attractive for in-house manufacturing. The budget does not, however, shed any light on these aspects, although the Prime Minister had talked of several measures at the recently concluded Aero India Show. The only concrete defence-specific measure visible in the budget is allocation for ‘Make’ projects for which Rs. 144.21 crore has been allocated. Although the budget is opaque in detail, the allocation, by far the biggest under the ‘Make’ head, would mostly be provided to two industry consortiums – one of TATA Power SED and L&T and the other of Bharat Electronics Limited (BEL) and Rolta India Ltd – each of which recently won a contract from the MoD to develop a prototype under the Indian Army’s Battlefield Management System (BMS) programme.

Impact of 14th Finance Commission on Defence

The 14th Finance Commission (FC), which was constituted to give recommendations on certain aspects of centre-state fiscal relations for the period April 2015 to March 2020, has made a number of recommendations that have far reaching implications for the central government’s budget making. The recommendations of the Commission have been ‘wholeheartedly’ accepted by the government in the spirit of ‘cooperative federalism’ that has been the guiding principle behind the newly created National Institution for Transforming India (NITI) Aayog. As mentioned earlier, the Commission has recommended the allocation of 42 per cent of the central government’s tax revenues to the States. The magnitude of this hike can be gauged from the fact that in the past when finance commissions have recommended an increase in states’ share, such increases were invariably in the range of one to two per cent.

The quantum jump in the devolution of tax revenues to the states would mean a proportionately reduced fiscal space for the central government. At the same time, the government also decided to discontinue only eight centrally sponsored schemes as against 32 schemes suggested by the Finance Commission. This further squeezes the fiscal space available to the centre. Given this, the hard reality is that defence has to compete with other sectors to maintain its share in what has now become a smaller central pie.

In addition, defence is also likely to be impacted by the roadmap suggested for it by the 14th Finance Commission. It is to be noted, however, that unlike the 13th Finance Commission which had given a roadmap covering both revenue and capital expenditure, the 14th Finance Commission has limited its projection to defence revenue expenditure only, arguing that capital expenditure is “beyond the scope of our assessment.” As per the roadmap, revenue expenditure is projected to grow by 13.5 per cent per year till 2019-20 (see Table VIII). However, while projecting this growth rate, the Commission has kept the revenue expenditure-GDP ratio at a constant 1.04 per cent, so as to allow revenue expenditure to grow at the same rate as the nominal GDP. In other words, if nominal GDP grows faster than 13.5 per cent (the growth rate assumed by the Commission for the projected period), revenue expenditure would also grow that much faster. At the same time, the converse is also true. Given this, the defence ministry would now hope that nominal GDP grows faster than 13.5 per cent in the remaining years of the projected period so that revenue expenditure remains in a healthy situation.

Table VIII. 14th Finance Commission’s Projection for Defence Revenue Expenditure

| Revenue Expenditure (Rs. in Crore) |

Growth (%) | Share of GDP (%) | |

| 2014-15 (BE) | 134412 | 1.04 | |

| 2015-16* | 152558 | 13.5 | 1.04 |

| 2016-17* | 173153 | 13.5 | 1.04 |

| 2017-18* | 196529 | 13.5 | 1.04 |

| 2018-19* | 223060 | 13.5 | 1.04 |

| 2019-20* | 253173 | 13.5 | 1.04 |

Note: BE: Budget Estimate; *: Projection

Source: Fourteenth Finance Commission

Conclusion

The eight per cent growth in the defence budget for 2015-16 is disappointing on several accounts. First, the modest increase would most likely enlarge the already huge gap existing between the MoD’s resource requirement and the allocation made in successive budgets. Second, the stagnation of capital expenditure, which is crucial for building new capability, would further delay the on-going modernisation process. Having said that, the latest defence allocation has to be seen in the light of the new centre-state fiscal relations in which the fiscal space of the central government has shrunk due to the implementation of the report of the 14th Finance Commission. From both the short- and long-term perspectives, this is a major cause of concern for sectors like defence, which are completely dependent on the central government for their resource requirement.

What is more significant is that if the fiscal space does not widen rapidly in the future due to subdued growth in revenue collection (as has been the case in 2015-16), defence will have very little for augmenting its capital assets. As evident, the entire increase of Rs. 17,727 crore in the 2015-16 defence budget would be consumed by revenue expenditure, with manpower costs accounting for nearly half of it. Given the new fiscal reality, the government has to ponder seriously if such a situation – wherein extra funds allocated in the budget do not go towards capital expenditure – can be allowed to persist.

Third, the 2015-16 defence budget is also disappointing on account of the lack of a defence-specific ‘Make in India’ initiative. In particular, the budget does not speak of measures promised by the Prime Minister at the Aero India exhibition. Considering that defence manufacturing, particularly by the private sector, needs substantial investment on plant and machinery, technology and skill development, it is high time the government begins to incentivise industry and implement the measures promised by the Prime Minister himself.

Views expressed are of the author and do not necessarily reflect the views of the IDSA or of the Government of India