Source : By Vinaykumar8687 (Own work) [CC BY-SA 4.0], via Wikimedia Commons

You are here

China’s Big Push for Solar Energy

Emerging markets are frontrunners in solar energy production and consumption. By overtaking the developed countries, emerging economies like China and India have become important players in the solar energy market. 1 While China is the largest consumer of coal and the second largest consumer of oil after the United States (US), it has also emerged as the leader in the renewable energy segment, doubling its production between 2008 and 2016.2 China’s previous target was to make renewables account for up to 20 per cent of electricity consumption by 2030, which it has revised to at least 35 per cent in the new plan called the Renewable Portfolio Standard.3 Revised targets became possible because China could attain the 2020 targets three years earlier.4Despite China’s thirst for energy to feed its growing industries, China is trying to adopt clean energy, especially solar energy, into its energy mix and has been leading in both solar photovoltaic (PV) installed capacity and solar power generation since 2015.5 Against this backdrop, this issue brief evaluates China’s forays into solar energy and how it is making it big in the international solar energy industry.

Emerging markets are frontrunners in solar energy production and consumption. By overtaking the developed countries, emerging economies like China and India have become important players in the solar energy market. 1 While China is the largest consumer of coal and the second largest consumer of oil after the United States (US), it has also emerged as the leader in the renewable energy segment, doubling its production between 2008 and 2016.2 China’s previous target was to make renewables account for up to 20 per cent of electricity consumption by 2030, which it has revised to at least 35 per cent in the new plan called the Renewable Portfolio Standard.3 Revised targets became possible because China could attain the 2020 targets three years earlier.4Despite China’s thirst for energy to feed its growing industries, China is trying to adopt clean energy, especially solar energy, into its energy mix and has been leading in both solar photovoltaic (PV) installed capacity and solar power generation since 2015.5 Against this backdrop, this issue brief evaluates China’s forays into solar energy and how it is making it big in the international solar energy industry.

Quest for Clean Energy

In a major move, China has made efforts to create a clean energy revolution in the past one decade. This has been driven by China’s resolve to address three key issues that have an impact upon the country. First, China’s commitment to the Paris Declaration has led to major policy changes in its renewable energy sector. In line with the Paris Agreement, it has agreed to lower its carbon intensity by 40 to 45 per cent below the 2005 levels. China’s leadership role in the Paris Declaration makes it imperative for Beijing to stick to its commitment, which will provide it greater legitimacy in the wake of the US withdrawal from the agreement. Second, China’s war against pollution requires that it switch to clean energy as a major component of its energy mix as well as invest heavily in renewable energy production.6 Being the largest carbon emitter in the world, China has pledged to halt the growth in its carbon emissions by 2030. Third, reducing overdependence on fossil fuels has been an important aspect of China’s search for energy security. Increased use of clean energy would reduce its dependence on oil imports, which is making China increasingly vulnerable to global instabilities as well as have a positive impact on the other two issues as well. Also, roughly two-thirds of China’s electricity production comes from coal, which is highly polluting.7

Driven by all these factors, China is aiming to improve the consumption of renewable energy with a particular focus on solar energy in which its current investments are at an all-time high.8 In 2017 alone, it invested USD 127 billion in renewable energy, out of which two-thirds went towards the generation of 53 GW (Gigawatt) of solar energy.9 By 2020, China plans to invest another USD 360 billion in renewable energy.10 The country’s commitment to renewable energy is evident from its 13th Five-Year plan (2016-20), which puts great emphasis on developing renewable energy.11 Currently, China is the leader in renewable energy technology and accounts for 40 per cent of the combined growth in the wind and solar photovoltaic (PV) sectors.12

Solar Energy Forays

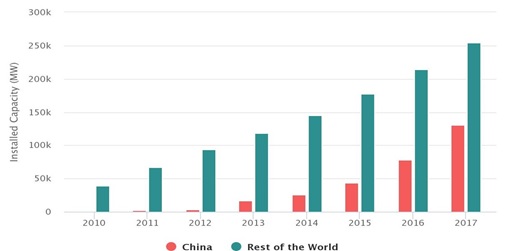

China assessed the growing demand for solar modules in the early 2000s when Western countries like the US, Germany and France began to give subsidies for solar PV installations.13 Wanting to be a part of the global solar revolution that was about to set in, China also started giving incentives since early 2009 for boosting domestic solar PV manufacturing and started the process of acquiring technology and skills needed for manufacturing PV cells.14 China was able to catch up with Western countries in critical technological areas mainly through the purchase of manufacturing equipment from a competitive international market and recruiting skilled labour, especially from the Chinese diaspora which had vast experience in PV manufacturing as well as setting up PV firms in developed countries.15 Apart from gaining access to technology, China has benefited from the increasing cost-effectiveness of renewable energy technologies which have ensured its growing presence in the solar energy industry.16 Consequently, China assumed the role of the largest solar market in the world, and has the highest installed solar capacity of around 130 GW, which has grown from a mere 2.5 GW in 2011.17 Currently, solar energy makes up seven per cent of China’s total generation capacity.18 In 2017, the country added around 50 GW of solar power capacity, up from 35GW in 2016, which also exceeded the combined capacity additions of coal, gas and nuclear.19 Interestingly, the new PV capacity added by China in 2017 alone is equivalent to the total solar PV capacity of Germany and France taken together.20 As per the report of the China Electricity Council, the country has added 34.52GW of new solar power from January to September 2018.21

Figure.1. Installed Solar PV Capacity from 2010 to 2017

Source: https://www.chinadialogue.net/article/show/single/en/10775-China-s-solar....

China has taken giant strides in solar energy technology, mainly PV manufacturing and deployment, which has also helped it assume the position of the largest manufacturer of solar panel technology in the world (more than 60 percent of the world’s total solar panels).22 Of the top ten solar panel manufacturers in the world, seven are Chinese (Figure 2).23 Canadian Solar, even though headquartered in Canada, is said to manufacture most of its solar panels in China.24 In 2017, China exported 37.9 GW of solar panels, which was 78 per cent more than its export in 2016.25

Figure.2. Top 10 Solar Panel Manufacturers in 2017 |

||

|

Ranking |

Company |

Country |

|

1 |

Jinko Solar |

China |

|

2 |

Trina Solar |

China |

|

3 |

Canadian Solar |

Canada |

|

4 |

JA Solar |

China |

|

5 |

Hanwha Q-CELLS |

South Korea |

|

6 |

GCL-SI |

Hong Kong |

|

7 |

LONGi Solar |

China |

|

8 |

Risen Energy |

China |

|

9 |

Shunfeng (including Suntech) |

China |

|

10 |

Yingli Green |

China |

|

Source: PV-TECH26 |

||

Large-scale manufacturing of solar panels has helped China venture to establish huge solar farms both within and outside the country. China has the largest solar farm in the world, the Longyangxia Dam Solar Park in Tibet, with four million solar panels spread over 10 square miles.27 Companies like Panda Green Energy that built the Panda-shaped arrays in Datong is planning to install similar farms in other parts of the country and abroad. 28The company’s ‘Panda 100 Program’ aims at building similar solar farms in the countries that are part of the Belt and Road Initiative (BRI). A 100MW Panda Power Plant can provide 3.2 billion kWh of green electricity in 25 years, equivalent to saving 1.056 million tonnes of coal, or reducing 2.74 million tons of carbon dioxide emissions.29 China can also boast of the world’s largest floating solar farm in Anhui province, which is being built by Sungrow Power Supply.30

Even though there is a boom in large-scale solar farms in different parts of China, reports suggest that the country’s distributed solar PV is growing much faster than large-scale solar power stations and accounts for 27.1 per cent of its total solar PV installations.31 This is because the government is keen to reform the state-owned power company, State Grid.32 Further, to manage its manufacturing overcapacity and wean itself from its over-dependence on overseas trade markets, the government has pushed for installation of solar panels domestically by extending incentives. The Solar Roofs Programme and the Golden Sun Demonstration Project are all part of the efforts to have a flourishing solar industry at home that is crucial for its economy.33

Factors Constricting China’s Growing Solar Industry

Even though the Chinese government has made enormous efforts to push solar energy in its energy mix and become a manufacturing hub of solar modules, there are several challenges that has to be addressed to create a better ecosystem for solar energy.

Even though state support in the form of incentives and subsidies has helped to burgeon solar installations in the country, the increasing incentives are putting a burden on the government, which cost is being transferred on to consumers.34 For instance, the state-run renewable energy fund, which is entirely financed by a surcharge on the power users’ bill, is running a deficit of more than 100 billion Yuan (USD 15.6 billion). This is going to be passed on to consumers.35 Most of the incentives given by China for solar energy is focused on PV manufacturing, and very little attention has been given to strategic siting and electric grid harmonization.36

The uneven spread of solar farms is another important aspect that has to be addressed to control curtailment37and transmission for better local consumption. Around 70 per cent of the solar farms in China are in the north and north-west regions, which are less populated but have enough land resources for solar installations.38 However, these areas have low energy demand as well as low export capacity, making it less efficient and relatively less useful for meeting China’s overall energy needs. The distance from the areas with high electricity demand, especially the south-east, has led to low capacity factor,39 as power is lost in the transmission process. Because the capacity factor of Chinese solar equipment is as low as 14.7 per cent, very little of the power produced is actually used. To address this issue, China has pushed for ultra-high voltage transmission lines that are capable of transporting electricity. China has reason to invest in the politically sensitive regions, especially Tibet, which has not only helped China exert its authority over the region but also has helped ethnic Chinese to move and settle in Tibet for the installation work.40

Apart from domestic issues, the Chinese solar industry is struggling to deal with the issue of import duties and tariffs imposed on its solar panels by different countries. In September 2012, the European Commission launched anti-dumping and anti-subsidy investigations into the import of Chinese solar panels, wafers and cells. After a nine month long investigation, the Commission concluded that Chinese companies were selling solar panels far below their actual market value, which was causing significant harm to the indigenous solar manufacturing sector in Europe.41 This led to the imposition of provisional anti-dumping duties on Chinese solar panels in 2013, which was extended in March 2017 by 18 months. In 2014, America slapped duties on Chinese solar panel imports. India, which imports more than 90 per cent of its solar panels and modules, imposed safeguard duties on solar panel imports from China in July 2018. Even though importing cheap Chinese solar panels has helped India reduce the cost of solar power generation and helped accelerate its renewable energy adoption, New Delhi decided to impose 25 per cent duty on Chinese solar cells and modules as imports are threatening the future of the domestic solar manufacturing sector.

In January 2018, the Trump Administration imposed further tariffs on imported solar panels, most of which come from China, and that increased the pressure on the Chinese solar industry.42 Several energy companies have suspended plans to install solar panels worth USD 2.5 billion.43 The imposition of tariffs on Chinese manufactured solar panels has also led to a drop in demand. Decreased demand has affected Chinese solar manufacturers, many of whom have filed for bankruptcy. The government has also decided to rein in the industry that is growing fast through measures such as suspending the allocation of additional quotas for new farms and cutting subsidies.44 China suspended subsidies for its large-scale solar farms for the second half of 2018 and has demanded that these plants set up power prices in competitive bids.

Emerging Scenarios

China’s recent policy changes in the solar sector are in line with the changing international environment as well as aimed at addressing growing domestic challenges. As per the new guidelines released in June 2018 by three state agencies, namely, the National Energy Administration, the National Development and Reform Commission, and the Ministry of Finance, any approval for new subsidised utility-scale PV power stations during the year has been terminated.45 Furthermore, China has also reduced the feed-in tariffs that would curb the unrestricted growth in solar power generation as well as address the issue of debts incurred by the state-run renewable energy fund to the tune of USD 15 billion, which will rise up to 39 billion by 2020 if left unaddressed.46 The solar projects that are connected to the grid after June 01, 2018 will not receive feed-in tariffs. Through these measures, China plans to reduce the subsidy costs, which it is struggling to pay. In an interview with the state news agency, Xinhua, an energy official said that “China’s decision to curb solar power capacity growth and cut subsidies will help the sector focus on quality rather than quantity and ease the financial burden on the government.”47

China is driving the growth in the international solar market, and the new policy will have severe consequences for stakeholders. Solar panel manufacturers have requested that the decision to cut subsidies be reconsidered as the sector is already going through financial difficulties. Subsidy cuts under these circumstances will only aggravate their financial position and even affect the solar plants already under construction.48 Companies like Sungrow Power have asked the government to grant a grace period to those in need of it.49 The slashing of subsidies by China is going to make it much more expensive to build large-scale solar farms.50

China’s 13th Five Year Plan has emphasized on improving electric grid planning and reducing curtailment issues. While the country prioritises energy efficiency, local realities continue to undermine this. The government has given directives in this direction, which are not being followed or implemented at the local level. 51 Considering the issues that are rising in the solar industry, the National Energy Administration (NEA) has come up with a set of guidelines in March 2018.52 These are intended to ensure that the provinces follow mandatory renewable portfolio standards. 53 It is now compulsory for each province to calculate its 2030 renewable power target (non-hydro), which is in alignment with the existing national target of achieving 35 per cent of electricity consumption by 2030 through renewables.54 Non-compliance with these standards would attract penalties and the revenue generated could be used to alleviate the subsidy-burden on the government.

Conclusion

China has taken giant strides in solar technology and manufacturing due to several policy changes and incentives. Even though it continues to use conventional energy as a major source in its energy mix, the country’s role as a major producer of renewable energy cannot be underestimated. While Chinese forays into the solar energy sector have been noticeable, there are several drawbacks in the country’s solar energy sector that is limiting it from reaching its full potential. Global protectionism, trade wars and slowing demand at home have affected China’s booming solar industry. Despite these challenges, China has shown resilience in steadily building its solar industry. China has managed to create an edge for itself in solar energy manufacturing and technology, and any shift in its solar policy is likely to affect countries looking to increase their solar energy capacity. Without doubt, China will continue to benefit from the growth in the international solar industry.

Views expressed are of the author and do not necessarily reflect the views of the IDSA or of the Government of India.>

- 1. Kiran Stacey, “China and India lead the surge to solar energy,” Financial Times, September 26, 2018, at https://www.ft.com/content/a42e23be-8900-11e8-affd-da9960227309 (Accessed on 26 December 2018).

- 2. Renewable Energy, “China has set the Benchmark High,” BRINK Asia, August 28, 2018, at http://www.brinknews.com/asia/renewable-energy-china-has-set-the-benchmark-high/ (Accessed on 26 December 2018).

- 3. “China steps up its push into clean energy,” Bloomberg, September 26, 2018, at https://www.bloomberg.com/news/articles/2018-09-26/china-sets-out-new-clean-energy-goals-penalties-in-revised-plan (Accessed on 26 December 2018).

- 4. Chris Baraniuk, “How China’s giant solar farms are transforming world energy,” BBC, September 04, 2018, at http://www.bbc.com/future/story/20180822-why-china-is-transforming-the-worlds-solar-energy (Accessed on 26 December 2018).

- 5. Min Yuan, Miao Hong and Mofan Zhang, “Distributed solar PV in China: Growth and challenges,” World Resource Institute, August 29, 2018, at https://www.wri.org/blog/2018/08/distributed-solar-pv-china-growth-and-challenges (Accessed on 26 December 2018).

- 6. Jeff Kearns, Hannah Dormido and Alyssa McDonald, “China’s war on pollution will change the world,” Bloomberg, March 09, 2018, at https://www.bloomberg.com/graphics/2018-china-pollution/ (Accessed on 26 December 2018).

- 7. Baraniuk, “How China’s giant solar farms are transforming world energy”.

- 8. Jeremy Hodges, “China shines bright as solar leads record renewables investment,” Bloomberg, April 05, 2018, at https://www.bloomberg.com/news/articles/2018-04-05/china-shines-bright-as-solar-leads-record-renewables-investment (Accessed on 26 December 2018).

- 9. Ibid.

- 10. Jiang Kejun and Jonathan Woetzel, “How China is leading the renewable energy revolution,” World Economic Forum, August 29, 2017, at https://www.weforum.org/agenda/2017/08/how-china-is-leading-the-renewable-energy-revolution (Accessed on 26 December 2018).

- 11. The total investment in renewable energy during the 13th Five Year plan period will reach 2.5 trillion Yuan. See, National Energy Administration, January 05, 2017, at http://www.nea.gov.cn/2017-01/05/c_135956835.htm (Accessed on 26 December 2018).

- 12. Global Energy and CO2 Status Report, International Energy Agency, March 2018, at https://www.iea.org/publications/freepublications/publication/GECO2017.pdf (Accessed on 26 December 2018) p. 9

- 13. Samuel Corwin, “How China can make the most of its solar energy boom,” The Diplomat, June 30, 2018, at https://thediplomat.com/2018/06/how-china-can-make-the-most-of-its-solar-energy-boom/ (Accessed on 26 December 2018).

- 14. Sufang Zhang and Yongxiu He (2013), “Analysis on the development and policy of Solar PV power in China,” Renewable and Sustainable Energy Reviews, 21, pp. 393-401.

- 15. Arnaud de la Tour, Matthieu Glachant and Yann Meniere (2011), “Innovation and international technology transfer: The case of the Chinese photovoltaic industry,” Energy Policy, Volume 39, Issue 2, pp. 761-70.

- 16. Renewable Energy Prospects: China, (IRENA, November 2014), at http://www.irena.org/-/media/Files/IRENA/Agency/Publication/2014/Nov/IRENA_REmap_China_report_2014.pdf (Accessed on 26 December 2018).

- 17. Jill Baker, “Solar leader China is slashing its subsidies on solar power-What you need to know,” Forbes, June 18, 2018, at https://www.forbes.com/sites/jillbaker/2018/06/18/solar-leader-china-is-slashing-its-subsidies-on-solar-power-what-you-need-to-know/#36ce0a362f9a (Accessed on 26 December 2018).

- 18. “China solar policies to boost quality, ease burden on government: Xinhua,” Reuters, June 12, 2018, at https://www.reuters.com/article/us-china-solar/china-solar-policies-to-boost-quality-ease-burden-on-government-xinhua-idUSKBN1J800D (Accessed on 26 December 2018).

- 19. “Global Energy and CO2 Status Report,” International Energy Agency, p. 9.

- 20. Ibid.

- 21. “China faces power supply risks as coal-fired capacity growth slows,” ET Energyworld, November 01, 2018, at https://energy.economictimes.indiatimes.com/news/coal/china-faces-power-supply-risks-as-coal-fired-capacity-growth-slows/66457000 (Accessed on 27 December 2018).

- 22. “Renewables 2017, International Energy Agency, October 04, 2017, at https://www.iea.org/renewables/ (Accessed on 26 December 2018).

- 23. Finlay Colville, “Top 10 module suppliers in 2017,” PVTECH, January 15, 2018, at https://www.pv-tech.org/editors-blog/top-10-module-suppliers-in-2017 (Accessed on 26 December 2018).

- 24. Larry Beinhart, “Why China, and not the US, is the leader in solar power,” Aljazeera, August 22, 2018, at https://www.aljazeera.com/indepth/opinion/china-leader-solar-power-180822102606141.html (Accessed on 27 December 2018).

- 25. Eric Ng, “China’s solar panel industry faces a year of reckoning amid global protectionism, slowing demand at home,” South China Morning Post, March 16, 2018, at https://www.scmp.com/business/companies/article/2137539/chinas-solar-panel-industry-faces-year-reckoning-amid-global (Accessed on 26 December 2018).

- 26. Finlay Colville, “Top 10 module suppliers in 2017”.

- 27. Brian Kahn, “This is what 4 million solar panels look like from space,” Climate Central, February 22, 2017, at http://www.climatecentral.org/news/china-solar-farm-satellite-21182 (Accessed on 26 December 2018).

- 28. “The world’s first panda power plant officially connected to the grid,” China Merchants New Energy, June 29, 2017, at http://www.cmnechina.com/en/index.php/artview-337-16.html (Accessed on 26 December 2018).

- 29. Ibid.

- 30. Jason Daley, “China turns on the world’s largest floating solar farm,” Smithsonian.com, June 07, 2017, at https://www.smithsonianmag.com/smart-news/china-launches-largest-floating-solar-farm-180963587/ (Accessed on 26 December 2018).

- 31. Min Yuan, Miao Hong and Mofan Zhang, “Distributed solar PV in China”.

- 32. “China is rapidly developing its clean-energy technology,” The Economist, March 15, 2018, at https://www.economist.com/special-report/2018/03/15/china-is-rapidly-developing-its-clean-energy-technology (Accessed on 26 December 2018).

- 33. Sufang Zhang and Yongxiu He, “Analysis on the development and policy of Solar PV power in China”.

- 34. Jill Baker, “Solar leader China is slashing its subsidies on solar power”.

- 35. Zhang Shidong and Eric Ng, Chinese solar power stocks plunge as government moves to contain industry size, South China Morning Post, June 04, 2018, at https://www.scmp.com/business/companies/article/2149131/chinese-solar-power-stocks-plunge-government-moves-contain (Accessed on 27 December 2018).

- 36. Samuel Corwin, “How China can make the most of its solar energy boom”.

- 37. Curtailment is the stranded power that is generated but do not get absorbed by the grid.

- 38. Yiyi Zhou and Sophie Lu, China’s Renewables Curtailment and Coal Assets Risk Map, Bloomberg New Energy Finance, October 25, 2017, at https://data.bloomberglp.com/bnef/sites/14/2017/10/Chinas-Renewable-Curtailment-and-Coal-Assets-Risk-Map-FINAL_2.pdf (Accessed on 26 December 2018).

- 39. Capacity factor is the percentage of electricity actually taken from any given resource.

- 40. Chris Baraniuk, “How China’s giant solar farms are transforming world energy”.

- 41. “EU imposes provisional anti-dumping tariffs on Chinese solar panels,” European Commission, Press Release, June 04, 2013, at http://europa.eu/rapid/press-release_IP-13-501_en.htm (Accessed on 28 December 2018).

- 42. China is rapidly developing its clean-energy technology, The Economist.

- 43. Tom DiChristopher, Goldman Sachs: Solar industry heading for a downturn after major Chinese policy shift, CNBC, June 07, 2018, at https://www.cnbc.com/2018/06/07/the-solar-industry-is-entering-a-downturn-says-goldman-sachs.html (Accessed on 26 December 2018).

- 44. Zhang Shidong and Eric Ng, “Chinese solar power stocks plunge as government moves to contain industry size”.

- 45. Emma Foehringer Merchant, “China’s bombshell solar policy shift could cut expected capacity by 20 Gigawatts,” Greentechmedia, June 06, 18, at https://www.greentechmedia.com/articles/read/chinas-bombshell-solar-policy-could-cut-capacity-20-gigawatts#gs.2bdULbw (Accessed on 26 December 2018).

- 46. Ibid.

- 47. “China solar policies to boost quality, ease burden on government: Xinhua,” Reuters, June 12, 2018, at https://www.reuters.com/article/us-china-solar/china-solar-policies-to-boost-quality-ease-burden-on-government-xinhua-idUSKBN1J800D (Accessed on 26 December 2018).

- 48. “Chinese solar panel makers urge government to delay subsidy cuts,” South China Morning Post, June 07, 2018, at https://www.scmp.com/news/china/policies-politics/article/2149752/chinese-solar-panel-makers-urge-government-delay (Accessed on 26 December 2018).

- 49. Ibid

- 50. Jill Baker, “Solar leader China is slashing its subsidies on solar power”.

- 51. Samuel Corwin, “How China can make the most of its solar energy boom”.

- 52. Hou Ander and Daniel Wezel, “New renewable energy quotas can be used to support renewable energy investments,” China Dialogue, April 04, 2018, at https://www.chinadialogue.net/blog/10574-China-is-planning-provincial-quotas-for-clean-energy-/ch (Accessed on 26 December 2018)

- 53. Renewable Portfolio Standards is a plan created by the National Development and Reform Commission (NDRC) and sets the minimum consumption level of electricity from renewable sources.

- 54. “China steps up its push into clean energy,” Bloomberg, September 26, 2018, at https://www.bloomberg.com/news/articles/2018-09-26/china-sets-out-new-clean-energy-goals-penalties-in-revised-plan (Accessed on 27 December 2018).

| Attachment | Size |

|---|---|

| 396.11 KB |