You are here

Unmanned Ground Vehicles: Global Developments and Future Battlefield

Summary: Unmanned Ground Vehicles (UGVs) will undoubtedly play a crucial role in military land operations in future. The integration of combat vehicles and autonomy is important to prevent loss of life during combat situations. Moreover, integration among different autonomous systems as a part of a unified platform for military innovation is the future of the battlefield. The UGV era is yet to reach its full potential and is presently in a latent phase. However, the geopolitical events and conflicts happening across the globe have allured the revolutionary potential of unmanned systems, due to which there is a renewed hype for the UGVs with accelerated advancements in robotics technology, artificial intelligence and machine learning. In addition, UGVs do not require a large industrial set-up as components and systems are now available commercially, however, there are still adoption challenges for militaries related to doctrines and tactical support systems. This issue brief explores the current UGV programmes, the unmanned or autonomous ground vehicle technology, its issues and challenges. It also discusses the potential of UGVs in military innovation, and the challenges, opportunities and scope of the UGVs in future.

Summary: Unmanned Ground Vehicles (UGVs) will undoubtedly play a crucial role in military land operations in future. The integration of combat vehicles and autonomy is important to prevent loss of life during combat situations. Moreover, integration among different autonomous systems as a part of a unified platform for military innovation is the future of the battlefield. The UGV era is yet to reach its full potential and is presently in a latent phase. However, the geopolitical events and conflicts happening across the globe have allured the revolutionary potential of unmanned systems, due to which there is a renewed hype for the UGVs with accelerated advancements in robotics technology, artificial intelligence and machine learning. In addition, UGVs do not require a large industrial set-up as components and systems are now available commercially, however, there are still adoption challenges for militaries related to doctrines and tactical support systems. This issue brief explores the current UGV programmes, the unmanned or autonomous ground vehicle technology, its issues and challenges. It also discusses the potential of UGVs in military innovation, and the challenges, opportunities and scope of the UGVs in future.

Introduction

The advertent use of technology has brought innovation and intelligent execution of tasks. However, the changing face of technologies like Artificial Intelligence (AI), Machine Learning (ML), Blockchain, virtual reality, augmented reality, and computer vision has disrupted the marketplace. The integration of these technologies has gained critical success and a plethora of applications, including autonomous vehicles. Autonomous vehicles (AVs) operate by themselves and perform intelligent execution of tasks with self-regulation and without any form of human intervention. Unmanned Vehicles can be categorised as Unmanned Ground Vehicles (UGVs), which are further classified as remotely operated and autonomous, Unmanned Under Water Vehicles (UUVs) and Unmanned Aerial Vehicles (UAVs).1 Unmanned Vehicle technology has seen significant progress in the past decade with research and development in the areas of defence, mining, construction, waste management, agricultural equipment, seaborne shipping, wildlife monitoring and unmanned aerial vehicles.2 Considering the success attained in UAVs and drones in various sectors, including defence and military, the focus is now more on UGVs. The research and development in UGVs is focused on autonomous self-driving vehicles capable of self-regulating on highways and congested cities. In the defence sector, much research is going on UGV development to undertake multiple missions like transportation, reconnaissance, rescue, detection of threats, combat operations, acquisition of targets, delivery of supplies and medication in remote areas, explosive ordinance disposal, extended tunnel mapping, mine clearance and more.

Unmanned Ground Vehicle Technology

In the past decade, Unmanned Ground Vehicle Technology has made major research breakthroughs by introducing autonomous systems for both commercial and defence sectors. The history of autonomous vehicles goes back to 1984, when ALV and Navlab developed the first AV from Carnegie Mellon University. Since then, much research and development has happened in this industry and advancements in robotics and AI have expanded across all sectors. The development of AVs relies on the Advanced Driver Assist Systems (ADAS), which defines and controls trajectories; Data fusion strategies that gather real-time information from various sensors; Actuation Technologies that include computer control steering, throttle, transmission and brakes; and Embedded Control Software. The various sensors used for the systems include Vision sensor, LIDAR, Radar, Ultrasonic Range, GPS, and Inter-Vehicle communication sensor. UGVs are generally embedded with three mobility levels: teleoperation, computer-aided driving and autonomous control. In addition, there are six levels of automation (0 to 5), level 0 being no driving automation, level 1–Driver Assistance, Level 2–Partial Driving Automation, Level 3–Conditional Driving Automation, Level 4–High Driving Automation and Level 5–Full Driving Automation. At present, research and development is focused on Level 5 automation in the commercial and defence sectors.3

UGV Technology Areas: The UGV-specific technology areas include perception and are based on sensors and mobility software for enabling situational awareness. Navigation and planning require the integration of perception, communication, path planning and various methods for navigation. Tactical behaviours and learning is another technology area where complex tactical behaviours like stealth operations and unstructured terrain environments are a challenge and still in their infancy. Human–Robot interaction, mobility, communication and power are some of the significant support technology areas that are essential for the development of UGV Systems.4

UGV Technology Issues: The most significant technology issue with UGVs is the basic mobility problems due to the complexity associated with unstructured terrains and cluttered and dynamic environments. The challenge is with the recognition capabilities, range and resolution, sensor interpretation, planning and execution of manoeuvres with multiple cooperating systems and under unknown threat conditions; behaviour and system architectures that require several approaches basis the complexity level; communication, power and mechanism design issues. Apart from these basic mobility issues, there are other challenges related to the mission payload, which are partial worked upon at this stage.5

Role of UGVs in Military Innovation

There has been tremendous growth in AVs in the Defence sector with advancements in autonomous aerial vehicles, drones, and air defence systems. Countries like the US, the UK, Russia and Israel leading the research and development in this space have now shifted towards increased innovations in autonomous ground vehicles. With the addition of such systems in their fleets, the countries will bring more autonomy, power and control in this space. The driving factor in this sector is the development of intelligent robots to perform combat operations and Intelligence, Surveillance and Reconnaissance (ISR) activities. Last year, the major dominance in this space was in the Small UGV section, where increased adoption of small UGVs was seen for search, rescue, ISR activities, and other military operations. A vast range of UGVs is being developed based on their size, mobility, mode of operation and system. The mobility of UGVs is segmented into wheeled, tracked, legged, and hybrid and the mode of operation is segmented into tethered, teleoperated and autonomous.6 The systems are categorised into navigation, payload, controller and power systems.

The revolutionary impact of UGVs on the future battlefield will be attributed through the confluence and advancements in robotics and disruptive technologies like AI, Data Science, ML, Virtual Reality, Augmented Reality, Internet of Things (IoT) and Cloud Computing. The major military innovation relies on the disruptive advancements in integration and inducement of autonomy for robotic combat vehicles for complex and unstructured environments beyond human-driven efficiency. The prospect of acquiring major military innovation is by leveraging new technology and measuring its implication through the hype cycle. However, the challenge is to measure the potential of new technology in military terms and its feasibility and deployment on the battlefield effectively. The technology’s exuberance with autonomy and fast-paced developments exhibits the concerns of deploying lethal autonomous weapons (LAWS) in combat. In case of strategic rivalries and geopolitical threats, possessing new military innovations with the latest technology for defence applications becomes indispensable. The robotic arms systems are becoming cheaper with a four-fold decrease in median price in the past six years from US$ 50,000 per arm in 2016 to US$ 12,845 in 2021.7 With new military innovations, the robotics research is becoming more accessible and affordable. The US’s Future Combat Systems Project (FCS) was initiated with an aim to deploy UGVs for multifunction logistics and equipment vehicles called MULE.8 Russia also made it clear by approving plans for introducing 30 per cent of Russian combat systems with complete robotic platforms by 2030. The Chinese military has devoted a research centre for unmanned systems to every major defence manufacturer.9 The UGV technology is reaching a considerable stage of maturity and will soon be a significant player in the weaponised defence systems of the state, leading to fully automated convoy operations integrated with all unmanned systems in theatre commands.

Defence Technology Advances in UGVs

The global unmanned ground vehicle market is anticipated to rise post-pandemic and will exhibit more innovations in this field. The autonomous ground vehicle market is segmented into North America, Europe, Asia, Middle East, and the leading players are the US, Israel, the UK, Estonia, and Russia. The Asian countries are anticipated to show more investments in the near future. China, India, and South Korea are devoted to procuring UGVs and especially autonomous ground vehicles for defence use. The confluence of technologies like AI, IoT, and Cloud Computing with UGV has created an ideal environment for creating intelligent autonomous systems both in the commercial and defence sectors. The growing demand for autonomous systems for commercial and defence use is propelling the market growth.

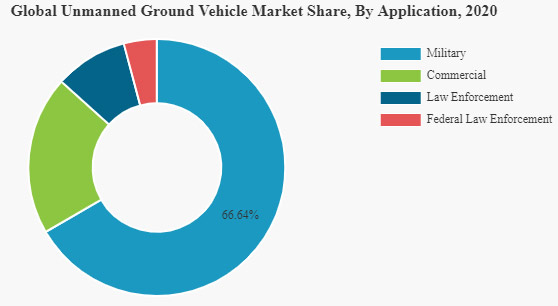

In 2020 and 2021, the global unmanned ground vehicle market size was US$ 2.68 billion and US$ 2.73 billion, respectively, which had experienced a decline due to the pandemic. In addition, the defence sector faced unprecedented challenges due to disruptions in the supply chain and delayed deliveries of UGVs, which affected the market growth. The significant market share of UGVs is in the defence sector, as mentioned in a report by Fortune Business Insights (see Figure 1). It is estimated that the market size will now pick up and, by 2028, will reach US$ 4.32 billion at a CAGR of 6.82 per cent during the forecast period.10

Advancements in the US: The availability of UGVs in different sizes and configurations caters to diverse missions and roles leading to seamless integration of ground forces with unmanned and autonomous systems. In 2017, the US doctrine on Robotics and Autonomous Systems Strategy (RAS),in its mid-term (2021–30) priorities enunciated the need to improve sustainment with fully automated convoy operations and improved manoeuvre with unmanned combat vehicles and advanced payloads.11 The US is the front-runner in the development of autonomous systems with UGVs like Dragon Runner 10, a 10-pound device developed by a North American company QinetiQ equipped with transceivers, day & night cameras and provides all the information to the operator from the remote location.12 Robotics Research, an autonomy and robotics technology developer, has created the Pegasus Mini, a hybrid Pegasus UGV/ UAV that can work on both land and air and is equipped with sophisticated GPS functions, high-speed, fully autonomous driving and flying capabilities.13 BAE Systems introduced another UGV platform prototype, Robotic Technology Demonstrator (RTD), designed for battlefield applications and is future-ready with adaptable sensors and advanced weapon systems. The Army Research Laboratory of the US is developing new UGV technologies like energy-efficient power generators for both military and commercial use. It is also working on Stirling Cycle Generator for autonomous ground vehicles.14 Milrem Robotics and QinetiQ have designed a modular UGV named Titan UGV to carry out multiple missions, including transport, reconnaissance and rescue. It also has capabilities to add functionalities to it.15 Pentagon’s Defense Research Projects Agency’s (DARPA) Robotic Autonomy in Complex Environments and Resiliency (RACER) programme has gained momentum and is field-testing the platform-based autonomy with the self-driving vehicles based on Polarisis RZR S4 1000 platform. The RACER programme is intended to integrate the robotic combat vehicles into army, marine corps and special forces communities. It also aims to develop simulation environments by creating advanced off-road autonomy algorithms.16

Advancements in China: China is vehemently developing unmanned systems in all domains and has been testing systems with AI capabilities. China North Industries Corporation’s Sharp Claw-1 has been deployed with the People’s Liberation Army Ground Force (PLAGF) for tracking and reconnaissance operations in rugged terrain and can carry out targeted attacks in all weather conditions.17 In addition, as part of Military Civil Fusion (MCF), China is seeking to increase the proportion of private companies for procurement of advanced robotic systems.18 In 2021, 7th China Military Intelligent Expo organised by Chinese Institute of Command and Control displayed the Pathbreaker UGV equipped with armed reconnaissance systems and strike guidance that can operate in complex environments at high mobility.19 Some other UGVs include the Giant Tiger and King Leopard UGVs that were displayed at the Airshow China in 2018 equipped with autonomous capabilities.20 All these developments are aimed at the acceleration of military intelligentisation for all-field combat capabilities.

Advancements in Russia: Russia’s interest in UGV led to the widespread renaissance when in 2017 Russian President called for the development of autonomous robotic complexes for the military.21 The evolution of UGV development and use in the Russian military ranges from Nerechta, R-27-BT, Platforma-M to Marker, Soratnik and Uran-6,9 and 14.22 Nerekhta is the smaller UGV, reportedly being tested in Syria, is AI-enabled and functions in modes like fire support, reconnaissance and as a transport vehicle.23 Some other UGVs that were tested in Syria were Uran-6, Scarab, Sphera and Uran-9.24 However, these UGVs can function when the operator is in close proximity. Moreover, Uran-9 faced several failures related to communication, firing, transportation and operator issues.25 The Russian forces are working on Uran-9 and will be conducting large-scale testing in 2022.26 Uran-14 is an advanced version of Uran-6, equipped with a firefighting mechanism.27 The Marker UGV was developed by the Foundation for Advanced Studies (FPI) and is a part of several developmental projects. The concept is to explore the technologies and systems it can work with and is part of the autonomous trips up to 200 km.28 In lieu of the failure with Uran-9, the Russian Ministry of Defence has stated the need to work through the concepts and tactics of using combat UGVs and would need another 10 years to come up with fully autonomous combat systems for classical military operations.29

Advancements in Israel: Israel Aerospace Industry (IAI) has been selected as the prime contractor for developing technologies for the future armoured fighting vehicle for the Israel Defense Force IAF—the Carmel.30 Carmel’s primary goal is to improve military ground manoeuvring capabilities with the extensive use of AI to manage battlefield decisions autonomously. The Carmel’s autonomous capabilities include driving, threat detection, defence and target acquisition, and all these features have been added to the Eitan IDF wheeled armoured personnel carrier. In addition, IAI Elta has introduced the concept of a see-through cockpit for battlefield situational awareness. IAI Elta Athena is another next-level technology (autonomous manoeuvrability, survivability, lethality) loaded with sensors and weapon systems that also have control of vehicle steering and engine. It also uses AI and deep reasoning capabilities to prioritise threats and is considered the brain of all sensors. It gathers intelligence, generates real-time recommendations on routes, seeks cover in case of storm or threat, and has firepower mechanisms. Another example of IAI’s autonomous ground vehicle fleet is the REX MK II, showcased at the Association of United States Army (AUSA) and London’s DSEI defence exhibitions. It is a logistic carrier capable of carrying 1.3 tons with features like onboard sensors for intelligence gathering and weapon systems.31

Advancements in the UK & European Countries: The UK Ministry of Defence Science and Technology Laboratory, under the project ‘Theseus’, is exploring the use of autonomous systems for resupply operations for capacity building of the army.32 The UK Ministry of Defence has also purchased HORIBA MIRA’s Viking and QinetiQ’s Titan UGVs that operate in hybrid mode and can carry payloads up to 600 kg and 750 kg, respectively.33 The UK Army has given the contract to IAI and Marlborough Communications Ltd to develop four unmanned ground vehicles on the lines of REX. Ukraine’s conspicuous UGV is the Fantom (Phantom), a combat vehicle equipped with a machine gun or a pop-up turret mounting and anti-tank missiles that can be operated from a ground control station about 5 to 10 kms away, based on fibre optic cables or through datalink respectively.34 German UGV named Mission Master developed by Rheinmetall is a multi-mission UGV equipped with MULE and modular payload capabilities.35

Advancements in India: In India, a Chennai-based company, Torus Robotics, in partnership with Bharat Earth Movers Limited (BEML), has developed an artificial intelligence-based UGV that can be used in extreme terrain and weather conditions and for logistics and surveillance. It was launched in February 2021.36 Torus Robotics is also involved in designing, developing and delivering fully electric unmanned ground vehicles for Indian defence services. Defence Research and Development Organisation (DRDO) has come up with a Mobile Autonomous Robotic System (MARS) UGV, and is also planning to develop UGV based on the Arjun MK 1A battle tank proposed by Chennai-based Combat Vehicles Research and Development Establishment (CVRDE) which will be equipped with a 120 mm gun and Indigenous Geographic Information System (INDIGIS).37 ARTPARK, a Bengaluru-based company, is setting up India’s first test track for the driverless vehicle on the lines of California-based Alphabet Inc owned Waymo. It will be one of the biggest test tracks globally, built on the 1,500-acre campus of the Indian Institute of Science (IISc).38 The Department of Science and Technology (DST) has sanctioned Rs 135 crore for setting up India’s one of the first Testbed for Autonomous Navigation Systems (Terrestrial and Aerial).39 In India, the research and development in autonomous vehicles have been accelerated considering the rapid advances in unmanned systems and their scope in the future battlefield. The various premier science and technology centres like IITs have initiated projects to develop autonomous vehicles, robots involving AI, deep learning and reinforcement agents. For instance, Indian Institute of Technology-Hyderabad has set up Technology Innovation Hub on Autonomous Navigation and Data Acquisition Systems (TiHAN).

Challenges and Opportunities

The development path of UGVs is still very challenging and problematic. Due to its autonomous nature, many factors are involved in raising societal impacts and technological and ethical concerns. With the reduction in defence budgets due to the pandemic, countries like India, South Korea, Russia, and Thailand have reduced and paused their defence expenditure in the AV industry. One of the biggest challenges with autonomous vehicles is technology advancement, which is not at the stage where the perception of the environment is entirely predictable, and there are still many unforeseen dangers involved with it. Some other challenges include lack of communication technology, planning and policies and regulations. The maintenance of security and integrity of such systems is highly vulnerable and needs to be addressed. The policymakers need to streamline, structure and regulate the autonomous system considering its diverse nature of vehicles, their operating constraints and capabilities.

The autonomous segment in UGVs will certainly see the highest growth in the defence sector with the increased use of small UGV and smart robots for military combat. These systems will have advanced AI, ML, and autonomous navigation capabilities that will allow UGVs to manoeuvre from pre-programmed locations and follow army convoys. The growth will be attributed to the growing defence needs and budgets and the increasing procurement of advanced robots for military operations. India needs a collaborative effort from all stakeholders, for which the Indian government needs to regularise and come up with a firm policy for autonomous vehicles. India has enunciated the indigenous development of combat systems and weapons with DRDO and its affiliates, and military–civil fusion will be a significant acolyte in this for the future of India’s defence set-up. AVs will be an indispensable part of our lives, and therefore, it is necessary to understand the future technology needs of the military, as the future battlefield will be a rundown of high tech enabled unmanned systems that will overcome the challenges of sustaining legacy forces and keeping human combatants safe from harm’s way.

Views expressed are of the author and do not necessarily reflect the views of the Manohar Parrikar IDSA or of the Government of India.

- 1. Saloni Walimbe, “The Role of Autonomous Unmanned Ground Vehicle Technologies in Defense Application”, Aerospace and Defense, 1 January 2022.

- 2. Shahian-Jahromi Babak, Syed A. Hussain, Burak Karakas and Sabri Cetin, "Control of Autonomous Ground Vehicles: A Brief Technical Review", in IOP Conference Series: Materials Science and Engineering, Vol. 224, No. 1, p. 012029; J. Anupama, A. Kavitha, S. Harsha and M. Karthick, “Design and Development of Autonomous Ground Vehicle for Wild Life Monitoring”, International Journal of Innovative Research in Computer and Communication Engineering, Vol. 2, No. 5, 2017, pp. 4227–34.

- 3. T. Litman, “Autonomous Vehicle Implementation Predictions”, Victoria Transport Policy Institute, Canada, 2017, p. 28; S.A. Bagloee, M. Tavana, M. Asadi, and T. Oliver, “Autonomous Vehicles: Challenges, Opportunities, and Future Implications for Transportation Policies”, Journal of Modern Transportation, Vol. 24, No. 4, 2016, pp. 284–303; T. Luettel, M. Himmelsbach, and H.J. Wuensche, “Autonomous Ground Vehicles—Concepts and a Path to the Future”, Proceedings of the IEEE, 100 (Special Centennial Issue), 2012, pp. 1831–39.

- 4. National Research Council, “Technology Development for Army Unmanned Ground Vehicles”, National Academies Press, 2003.

- 5. Naval Studies Board and National Research Council, “Autonomous Vehicles in Support of Naval Operations”, National Academies Press, 2005.

- 6. S.G. Fernandez, K. Vijayakumar, R. Palanisamy, K. Selvakumar, D. Karthikeyan, D. Selvabharathi, S. Vidyasagar, and V. Kalyanasundhram, “Unmanned and Autonomous Ground Vehicle”, International Journal of Electrical and Computer Engineering, Vol. 9, No. 5, 2019, pp. 44–66.

- 7. “AI Index Report 2022:Measuring Trends in Artificial Intelligence”, Human Centered Artificial Intelligence, 11 April 2022.

- 8. Ash Rossiter, "Bots on the Ground: An Impending UGV Revolution in Military Affairs?", Small Wars & Insurgencies, Vol. 31, No. 4, 2020, pp. 851–73.

- 9. Ibid.

- 10. “Unmanned Ground Vehicle Market Size”, Fortune Business Insights Report, 2021.

- 11. “The U.S. Army Robotic and Autonomous Systems Strategy”, U.S. Army Training and Doctrine Command, March 2017.

- 12. No. 1.; “Dragon Runner Small & Compact Robot”, Qinetiq.

- 13. Kelvin Wong, “Robotic Research Unveils Pegasus Mini Hybrid UAS/UGV”, JANES, 7 January 2020.

- 14. No. 1.

- 15. “Titan Unmanned Ground Vehicle (UGV)”, Army Technology, 29 June 2020.

- 16. Inder Singh Bisht, “DARPA to Field Test Autonomous Military Off-Roader”, The Defense Post, 18 January 2022.

- 17. Juan Ju, “Norinco's Sharp Claw I UGV in Service with Chinese Army”, JANES, 15 April 2020.

- 18. “Military and Security Developments Involving the People’s Republic of China 2021”, Annual Report to Congress, DOD US.

- 19. Liu Xuanzun, “China Displays Land, Sea, Air Combat Robots at Expo”, Global Times, 5 July 2021.

- 20. Zarvan, “China Closing the UGV Gap with US, Russia”, Pakistan Defence, 24 November 2018.

- 21. Samuel Bendett, “Get Ready, NATO: Russia’s New Killer Robots are Nearly Ready for War”, The National Interest, 7 March 2017.

- 22. Jörgen Elfving, “Russian UGV Developments”, European Security & Defence, 7 November 2019.

- 23. Samuel Cranny Evans, “Russia to Conduct Mass Testing of Uran-9 UGV in 2022”, JANES, 5 October 2021.

- 24. Samuel Bendett, “Russian Unmanned Vehicle Developments”, Center for Strategic and International Studies, 2020.

- 25. Ibid.

- 26. No. 23.

- 27. No. 22 .

- 28. David Hambling, “Russia’s Autonomous Robot Tank Passes New Milestone (And Launches Drone Swarm)”, Forbes, Aerospace & Defense, 2 September 2021.

- 29. No. 24.

- 30. “IAI Selected as Prime Contractor for the Carmel Program”, IAI Press Release, 2021.

- 31. Lappin Yaakov, “Accelerated Development of Autonomous Ground Vehicles is Revolutionizing Israel’s Military and Defense Industries”, TRENDS Research & Advisory, 22 November 2021.

- 32. Norbert Neumann, “Robot Wars: The Battle for Automated Ground Capability”, Army Technology, 4 November 2021.

- 33. No. 15.

- 34. Sebastein Roblin, “Killer Army Robots for Ukraine?”, The National Interest, 25 September 2019.

- 35. No. 8.

- 36. No. 10; Shreya Ganguly, “Chennai-based Startup Builds Unmanned Ground Vehicles for the Indian Army”, YourStory, 2 March 2021.

- 37. Jon Grevatt, “India Plans to Develop Combat UGV Based on Arjun Tank”, JANES, 12 April 2022.

- 38. Leslie D’Monte, “ARTPARK Plans India’s First Autonomous Vehicle Test Track”, Live Mint, 19 August 2021.

- 39. Samiksha Mehra, “How are India's IITs faring in Autonomous Vehicles Research?”, India AI, 9 July 2021.