You are here

Israel–Lebanon Maritime Boundary Agreement: An Assessment

Summary: The Lebanon–Israel maritime boundary agreement may bring security, stability, and mutual economic benefits. The agreement can be expected to mute the security deficit to an extent, given that any military conflict between Israel and Hezbollah will impact optimum extraction of the gas resources. Prime Minister Benjamin Netanyahu, who was critical of the agreement while out of office, may not be expected to cause a rift in Israel’s relationship with the US by abandoning it or hurting its implementation, given that it came about after intensive US-mediated diplomacy, which was no doubt hastened by the energy security implications flowing out of Russia’s military intervention in Ukraine.

Summary: The Lebanon–Israel maritime boundary agreement may bring security, stability, and mutual economic benefits. The agreement can be expected to mute the security deficit to an extent, given that any military conflict between Israel and Hezbollah will impact optimum extraction of the gas resources. Prime Minister Benjamin Netanyahu, who was critical of the agreement while out of office, may not be expected to cause a rift in Israel’s relationship with the US by abandoning it or hurting its implementation, given that it came about after intensive US-mediated diplomacy, which was no doubt hastened by the energy security implications flowing out of Russia’s military intervention in Ukraine.

Introduction

Israel and Lebanon announced on 11 October 2022 that they reached a historic agreement to establish a permanent maritime boundary between them. The agreement was formally signed by Prime Minister Yair Lapid and President Michel Aoun, separately, on 27 October 2022. The agreement was mediated by the United States. While the current phase of negotiations to find a solution to the maritime boundary issue began in October 2020, talks have been ongoing since at least a decade. This Brief examines aspects relating to maritime boundary delimitation as per the United Nations Convention on the Law of the Sea (UNCLOS) and the tangled web of negotiations between Israel and Lebanon which eventually culminated in the delimitation agreement in October 2022. The Brief ends by highlighting the implications of this historic agreement.

Maritime Boundary Delimitation: UNCLOS

As per the 1982 UN Convention on the Law of the Sea (UNCLOS), countries can claim up to 12 nautical miles from their coasts as territorial waters (One nautical mile is approximately 1.15 miles). UNCLOS also allows countries to claim a further 200 nautical miles as an exclusive economic zone (EEZ) for fishing and mineral rights. In the event that the waters between two countries are not wide enough to allow for claims of that size, the agreed midpoint becomes the boundary. Oil and gas fields can extend beyond such boundaries; in such cases, internationally established mechanisms are often used to split costs and revenues proportionally.

The UNCLOS uses similar delimitation provisions both for EEZ and Continental Shelves. Articles 74(1) and 83(1) stipulate that ‘the delimitation… between States with opposite or adjacent coasts shall be effected by agreement on the basis of international law… in order to achieve an equitable solution’.1 In addition, UNCLOS also encourages states to explore temporary solutions at delimitations through joint efforts. Articles 74(3) and 83(3) of the Convention specifies that ‘Pending agreement … the states concerned, in a spirit of understanding and co-operation, shall make every effort to enter into provisional arrangements of a practical nature … Such arrangements shall be without prejudice to the final delimitation’.2

Unarguably, there is no one-size-fits-all formula for projecting lines out to sea to assert maritime separation boundaries. While there exist principles, procedures, and best practices widely viewed as appropriate in terms of cartography and international law, there are also variables regarding the validity and weight of land-based reference points on both sides of the boundary employing equidistance to project a line. These variables, used by two parties making competing claims, can produce two lines sharply at variance, but each consistent with customary international practice.

Within the ambit of broad variables for maritime boundary delineation, the equidistance (or median) line technique has been a preferred method as starting point for delimitation negotiation among the states. As per this method, the maritime boundary is the median line, ‘every point of which is equidistant from the nearest points of the baselines from which the breadth of the territorial sea of each State is measured’.3

However, to draw a maritime border and EEZ boundary, countries that share a coastline must agree on two points: the point of origin of the median line (typically where their land border reaches the sea), and its angular bearing from the coast. Given that both points had been a subject to dispute, Israel and Lebanon’s sharply differing views on maritime boundaries, therefore, represented a significant challenge in dispute resolution.

Israel-Lebanon Maritime Boundary Dispute: A Tangled Web

Military skirmishes took place between the Lebanese Army and the Israel Defence Force (IDF) in the Galilee, after the Jewish state was formed in May 1948. An agreement was reached between the two sides in 1949, termed the Armistice Demarcation Line (ADL), which reiterated the 1923 Paulet-Newcombe border agreement established between the then colonial powers, the French and the British.4 In the aftermath of the Israeli military intervention in southern Lebanon against the Palestine Liberation Organisation (PLO) in 1978, the United Nations Security Council (UNSC) adopted Resolutions 425 and 426 urging withdrawal of Israeli forces and called for the ‘strict respect for territorial integrity, sovereignty and political independence of Lebanon within its internationally recognized boundaries’.5

Subsequently in 1982, Israel launched ‘Operation Peace for Galilee’, and did not withdraw from southern Lebanon till May 2000. On 7 June 2000, the United Nations established the Blue Line between Lebanon and Israel for the purposes of determining whether Israel had fully withdrawn from that country. While Israel insisted that it withdrew from Lebanese territory completely, Lebanon still had reservations on the Blue Line given that it contended that it infringed on some Lebanese villages.6

As for principle of maritime boundaries being co-terminus with land borders, the 1923 Paulet-Newcomb Agreement states that ‘the border leaves the Mediterranean Sea at the known point Ras-el-Nakura and follows the peak crest to landmark I, located 50 meters north of the Palestinian police post in Ras-el-Nakura’.7 While Ras en Naqoura/Rosh Ha Nikra is broadly recognised as a reference point for boundary delineation, there existed significant divergences over exact coordinate border markers among rocks located at the base of Ras an Naqoura/Rosh Ha Nikra cliff. In any case, the area has not been jointly surveyed for border demarcation purposes. However, after the May 2000 withdrawal, the State of Israel unilaterally installed a line with ten buoys, which became known as the Line of buoys (LoB) as a marker for maritime boundary, which was not recognised by Lebanon.8

So even with a common reference of Ras en Naqoura/Rosh Ha Nikra for maritime boundary delineation, there existed a divergence between Israel and Lebanon, with one claiming that the landmark would be 35 meters to the north and the other to the same extent, only to the south.9 The critical divergences over common point on land and resultant differences of angle of coast alignment resulted in both Lebanon and Israel extending two different lines at sea in separately negotiated EEZ demarcation with the Republic of Cyprus, in 2007 and 2010 respectively.

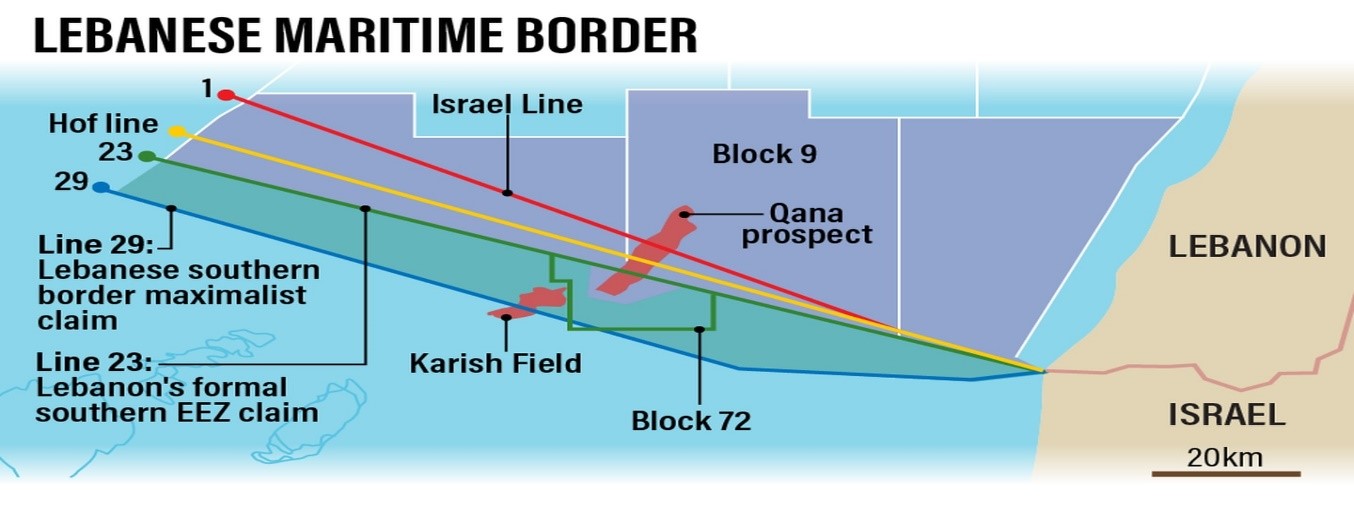

The basis of the dispute related to differing perception of median line and resultant divergences over position of tri-junction between Israel, Cyprus and Lebanon. Within bounds of customary international law, Lebanon made its designated ‘Line 23’ bend south, nearly touching established Israeli exploratory gas fields, while Israel made its ‘Line 1’ veer toward the north, rendering 882 square kilometers of Mediterranean Sea disputed.10

Cyprus and Lebanon entered a bilateral agreement compliant with UNCLOS to delimit their maritime border in 2007. This agreement was not ratified by the Lebanese Parliament due to the unresolved nature of its maritime dispute with Israel.11 In July 2010 and October 2010, Lebanon submitted to the UN coordinates for delimiting its southern and southwestern EEZ borders with Israel and Cyprus respectively. Lebanon claimed that ‘Coordinate 23’ was the southernmost point, which formed the median line between the three states. In December 2010, an agreement was signed between Cyprus and Israel, in which ‘Coordinate 1’ was set as the northern border point of the delimitation of the maritime border between the countries.12

Lebanon objected to ‘Coordinate 1’ as well as the land coordinate from which Israel’s median line had originated.13 Lebanon insisted that the maritime agreement between Cyprus and Israel, ‘the Occupying Power’, was ‘completely incompatible with the geographical points that Lebanon had deposited with the United Nations, and absorb part of the exclusive economic zone of Lebanon, which constitutes a flagrant attack on Lebanon's sovereign rights over that zone’.14 Notwithstanding the Lebanese protest, Israel submitted these coordinates to UN in July 2011.15 In October 2011, Lebanon passed Decree 6433, defining its EEZ formally in law.16

The intensification of territorial dispute through claims and counter claims, in a proximate sense, resulted from conflicting ownership claims over potential gas fields, apart from long-standing historical contentions. In March 2010, a report by the US Geological Survey on the ‘Assessment of Undiscovered Oil and Gas Resources of the Levant Basin Province, Eastern Mediterranean’ estimated the unexplored potential reserves in the Levant Basin at around 1.7 billion barrels of recoverable oil and 122 trillion cubic feet (TCF) of recoverable gas.17 With both Israel and Cyprus having designated their EEZ in 2010, this large quantity of reserves prompted the Lebanese government to define its EEZ, in an attempt to secure its offshore natural resources.

The potential profits from oil exploration in the disputed area and competing claims of both sides, however, led to intensification of the maritime dispute. Israel, for instance, aired its objections to the UN Secretary General in February 2017 when reports noted that Lebanon was contemplating awarding offshore gas exploration licenses in the disputed area. Israel urged Lebanon to ‘refrain from non-consensual activities in maritime areas belonging to Israel’.18 Israel raised similar concerns on Lebanese activities in letters to the UN Secretary General in December 2017, July 2019, November 2021 and December 2021, respectively. Lebanon, on its part, also objected to Israeli activities in territorial waters contended by it, as in January 2020, when it flagged the alleged violation of its EEZ by a survey ship. Israel contended that a storm forced the vessel to relocate and that the vessel was only exercising its ‘freedom of navigation, a fundamental principle of international law’.19

US Mediation: Tortuous Journey

Due to the lack of diplomatic relations between Lebanon and Israel, third-party mediation was the apparent option for dispute settlement. While initially Lebanon preferred UN mediation, Israel not being a party to the 1982 UNCLOS posed a legal complication. Israel’s historical distrust with UN mediation was an additional factor. Therefore, the United States, under the Barack Obama administration, emerged as the logical mediator in 2011.

In 2012, the US appointed its Special Envoy to Syria and Lebanon, Frederic Hof, to negotiate a settlement over the dispute. The ‘Hof Line’ was proposed as a compromise, using UNCLOS delineation methods. The compromise solution provisionally demarcated the disputed area into a roughly 55:45 ratio between Lebanon and Israel without revoking Lebanon’s right over the complete disputed area.20 Hof pledged that the US administration would convince Israel the temporary solution would not hinder the interests of the Israeli and Lebanese sides in exploring gas and oil resources. While the Israel side was amenable to this provisional solution, the Lebanese government rescinded from the mediation due to domestic political dynamics, including Hezbollah’s intransigence.

Even while the US mediated negotiation was ongoing, Lebanon commissioned a study by the United Kingdom Hydrographic Office (UKHO) to review its maritime boundary coordinates. The UKHO report proposed two potential lines demarcating the southern border of the EEZ – the first line gave Lebanon an additional 300 square kilometers, while the second added 1,430 square kilometers to Lebanon’s 2009 maritime border, which became known as ‘Line 29’.21

After the failure of Hof mediation, Lebanese interlocutors began to insist on ‘Line 29” as the limit of Lebanese claim. While previously ‘Line 23’ had created partial claims of both the countries over the prospective gas field, Qana, Lebanon now laid partial claim over Israel’s Karish gas field, as per ‘Line 29’. 22

Figure 1. Lebanese Maritime Border

Source: Joyce Karam and Adla Massoud, “Maritime Deal between Lebanon and Israel could be days away”, The National News, 20 September 2021.

Amos Hochstein, an Israeli-born American diplomat and energy expert, took over from Hof during the Obama administration’s second term. Hochstein in 2013 proposed to draw a maritime ‘blue line’ resembling the line used to demarcate the Lebanese-Israeli land border. The ‘new’ temporary line aimed to mitigate frictions by prohibiting exploration within the disputed area till a settlement was finalised. Even though Lebanon was amenable to this proposal, it did not find favour in Israel.23

During the Trump administration, mediation efforts to seek settlement continued through David Satterfield and David Schenker, who held the position of Acting US Assistant Secretary of State for Near Eastern Affairs. Beirut’s insistence on its maximalist demand based on ‘Line 29’ led to a breakdown in talks in the waning days of the Trump administration.24

After the Biden administration came to power, Hochstein returned as the US Mediator and a fresh round of shuttle diplomacy was launched. Due to familiarity with interlocutors from both sides and their negotiating positions, Hochstein was expected to pick up threads from his earlier negotiations in 2016. However, Lebanon’s position in 2021 had considerably changed given the claims over Karish oil fields as per Line 29. A further complication was on account of the weak caretaker government in Israel and Lebanon’s precarious economic and political situation. In addition, Hezbollah considered Israeli extraction of gas from Karish as a “red line” and threatened violence.

Tension ran high during the summer, when Energean, Israel’s concessionaire in Karish oil field, began prospecting for gas. Hassan Nasrallah, the Hezbollah chief, warned that in the absence of an agreement, Israel prospecting or exploiting gas of the Karish field is a “red line”. Israel’s Defence Minister Benny Gantz then warned that “If Nasrallah wants to try and harm and to complicate this process, he is welcome to do so: the price is Lebanon”.25 Hezbollah sent three unarmed drones towards an Israeli rig which was present near the waters of the Karish gas field. The three Hezbollah drones were shot down by an Israeli warship, with reports noting that it was the first time an air defence system mounted on an Israeli warship had downed incoming targets.26 Notwithstanding prevailing tensions and mutual suspicions, maritime boundary negotiations continued uninterrupted.

Rather than seeking compromised outcomes through division of disputed area, Hochstein engaged both parties to define a mutually agreed outcome which could safeguard their vital interests.27 Israel made concessions on the boundary line, foregoing its claim based on ‘Line 1’. Lebanon recognised Israel’s control of a three-mile stretch of water close to shore and shifted its claim back to ‘Line 23’. The resulting deal has been termed as “historic” by both sides.28

The Agreement: Key Highlights

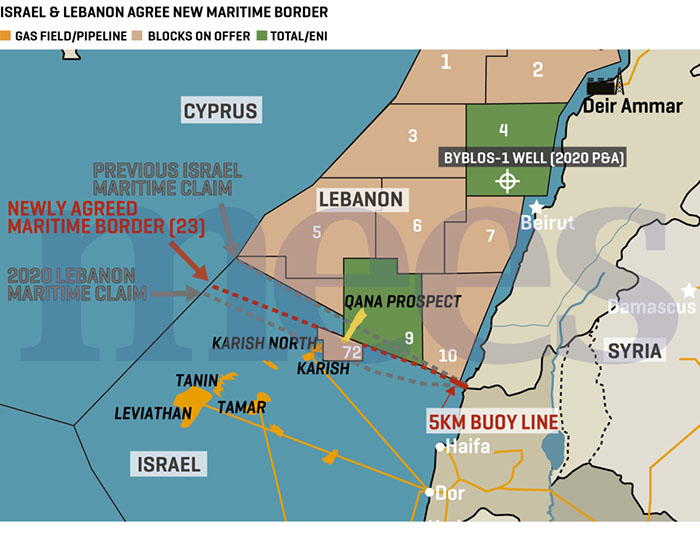

The Agreement comprises four sections.29 Section 1 stipulates the exact location of the ‘permanent and equitable’ maritime boundary line (MBL). Section 2 regulates the terms of exploration of a specific transboundary hydrocarbon prospect. Section 3 deals with all other transboundary deposits which may be discovered in the future and Section 4 relates to the settlement of disputes, ratification, and entry into force. The main text of the Agreement does not explicitly identify the maritime zones being delimited. However, the accompanying text refers to delimitation of the territorial sea and the EEZ. Based on the equidistance method, the agreed MBL broadly aligns with Lebanon’s ‘Line 23’.

While defining the coordinates of the MBL, Section I explicitly notes that it is ‘without prejudice to the status of the land boundary’ and both sides agreed to maintain the status quo. It states that the ‘maritime boundary landward of the easternmost point of the MBL is expected to be delimited in the context of, or in a timely manner after, the Parties’ demarcation of the land boundary’. Lebanon has been assigned prospecting right over the Qana gas field even though a portion of the reservoir extends into the Israeli EEZ. While the agreement provides for a revenue sharing agreement for gas extracted from the Qana gas field, the agreement avoids politically sensitive issue of bilateral recognition between countries. Under the terms of the agreement, the entire prospect will be developed by the operator of Block 9 “exclusively for Lebanon”, but this is subject to the agreement between Israel and the operator, the French company Total, over financial terms.

To avoid implied reference to normalisation, the text specifies that Israel “will be remunerated by the Block 9 Operator” without involving Lebanon in these arrangements and without affecting Lebanon’s agreement with the company nor its share of profits. With concurrence of both parties, the agreement also makes it possible for the operator to drill south of the maritime boundary line as Qana prospect may extend—at least partially—into Israel’s Block 72.30 Both states have renounced unilateral action in the Qana Prospect and instead will establish a system of prior notification and coordination.

Figure 2. Israel–Lebanon Maritime Border Agreement

Source: “Lebanon and Israel Reach Deal on Maritime Border”, The East Med Energy Report, Issue 11, 17 October 2022.

The procedure in the event of a discovery of transboundary natural resources, other than the Qana Prospect, has been specified in Section 3. Three basic elements has been specified in this transboundary clause. First, it is not limited to hydrocarbons but includes other mineral deposits such as sand and gravel. Second, the clause applies when such a transboundary deposit can be exploited from either side of the boundary. The exploitability criteria aims to prevent unilateral exploitation of transboundary resources by one side. The third element mandates a US-facilitated arrangement for the coordinated development and exploitation of such transboundary resource.

The dispute resolution clause in the Agreement [Section 4(A)] stipulates that ‘any differences concerning the interpretation and implementation of this Agreement’ must be resolved ‘through discussion facilitated by the United States’. A discussion facilitated by the US is not a binding form of resolution. It can include anything from direct or indirect consultation, negotiation, mediation, and/or even expert determination.

Going Forward

The Lebanon–Israel maritime boundary agreement, whilst not perfect, may well be a win-win proposition if implemented in good faith. It may bring security, stability, and mutual economic benefits. It also promotes the rule of international law, peaceful settlement of disputes, and regional economic cooperation. The agreement is expected to give a fillip to the resolution of pending maritime boundary contentions, between Lebanon and Cyprus as well as perhaps between Lebanon and Syria, going forward. As noted earlier, the 2007 Lebanon–Cyprus agreement was not ratified by the Lebanese parliament. Turkiye and Greece, the major stakeholders in Cyprus at opposite ends of the conflict spectrum, have welcomed the Israel–Lebanon agreement. The Turkish Foreign Ministry, for instance, noted that it was a ‘model, which … sets a good example for the region and in particular for the Turkish and Greek Cypriots’.31

For Israel, Karish became the third offshore gas producing field, after the Tamar and Leviathan fields, on 23 October. While reports noted that the field has a capacity of 8 billion cubic metres (bcm), Energean, the company drilling for gas in the field, notes that ‘the Karish Field contains 1,409 bcf [billion cubic feet] gas 2P [proven + probable] reserves plus 61 mmbls [million barrels] liquids 2P reserves. This represents a total of 317 mmboe [million barrels oil equivalent] 2P reserves’.32 1,409 bcf is equivalent to 1.4 trillion cubic feet (TCF) or around 40 bcm.33 As per the recommendations of the 2018 Adiri Committee (headed by Uri Adiri, Director General of the Ministry of Energy), natural gas fields that contain less than 50 BCM are not required to supply to the domestic market.34

Israeli domestic gas consumption meanwhile is expected to reach 14.3 bcm in 2025 and 25.8 in 2042, and cumulatively be worth 452 bcm from 2018 to 2042.35 Around 70 per cent of Israel’s energy needs currently are being met by natural gas. Reports note that Israel has around 1,000 bcm of gas reserves. Given that its requirements are not expected to cross 450–500 bcm by 2042, more than half of its current gas reserves can potentially be exported. As per Israel’s current agreements with Jordan and Egypt, around 135 bcm is contracted to be exported.36 During the first half of 2022, Israel exported gas to the tune of US$ 250 mn, an increase of nearly 50 per cent from the previous year.37

The Israeli Ministry of Energy finished three rounds of bids for gas exploration in the country’s EEZ so far, in November 2016, October 2019 and June 2020. While the winners of the first and second rounds were announced, the results of the third round have not yet been announced. Israel’s Energy Minister Karine Elharrar had in December 2021 held that the country may not explore new natural gas fields in the Mediterranean and will instead focus on green energy. In May 2022, however, in the wake of the Ukraine war, the freeze on gas exploration was lifted.38

In June 2022, Israel along with Egypt, signed a MoU with the European Union, as part of which Israeli gas will be transported to Egypt and from there to the EU markets.39 Israel has a 10 year contract with Egypt, signed in 2018, for supply of gas from the Leviathan field. The first gas exports (to Egypt) from the field began in January 2020. Egypt and Israel are also part of the East Mediterranean Gas Forum (EMGF), along with Italy, Jordan and the Palestinian Authority, formed in January 2020 and headquartered in Cairo. Though cost and other issues have been flagged, the ambitious 2,000 km EastMed pipeline is also being pursued by these countries.40 The pipeline will run from Israel to Cyprus, Crete, Greece and Italy.

Prime Minister Yair Lapid, therefore, while welcoming the signing of the maritime boundary agreement with Lebanon, stated that the deal ensures the ‘energy security of the State of Israel and will bring in billions in revenue that every family in Israel will benefit from’.41 As for Lebanon, the French energy major, Total, will start exploring for gas in the Qana field in 2023. Lapid noted that Israel will receive at least 17 per cent of the revenues from the Qana-Sidon field, as and when it will become operational. The revenue sharing agreement will be negotiated by Israel directly with Total, without Lebanese involvement.

As for regional security implications, given the brinkmanship between Hezbollah and Israel over the Karish field just a few months back, Hezbollah’s ‘green-light’ for the agreement is indeed significant.42 Reports note that Lebanon’s potential profits from gas that could be discovered in the Qana field could be to the extent of US$ 6 billion.43 This amount is not significant compared to the country’s debt in 2021 of over US$ 90 billion.44 However, the agreement can still be expected to mute the security deficit to an extent, given that any military conflict between Israel and Hezbollah will impact optimum extraction of the gas resources.

Prime Minister Benjamin Netanyahu, while out of office, termed the agreement as a “historic surrender” that would benefit Hezbollah and criticised then Prime Minister Lapid for trying to evade parliamentary scrutiny.45 Just prior to Election Day, Netanyahu insisted that he will “neutralize” the agreement, just like he did with the Oso Accords.46 Analysts though point out that even with the Oslo Accords, Netanyahu ratified them and implemented its provisions.47 The new Israeli prime minister may not be expected to cause a rift in Israel’s relationship with the US, given that the agreement came about after intensive US-mediated diplomacy, which was no doubt hastened by the energy security implications flowing out of Russia’s military intervention in Ukraine.

Views expressed are of the author and do not necessarily reflect the views of the Manohar Parrrikar IDSA or of the Government of India.

- 1. “United Nations Convention on the Law of the Seas”, United Nations, pp. 49, 83.

- 2. Ibid., pp. 49, 83.

- 3. Ibid., Article 15, p. 26.

- 4. Laura Zittrain Eisenberg, “Do Good Fences Make Good Neighbors? Israel and Lebanon after the Withdrawal”, Middle East Review of International Affairs (MERIA), Vol. 4, No. 3 (September 2000); see also “Exchange of notes constituting an Agreement respecting the boundary line between Syria and Palestine from the Mediterranean to El Hammé”, British–French Boundary Agreement, 7 March 1923.

- 5. “Resolution 425 (1978) and Resolution 426 (1978)”, United Nations Security Council, 19 March 1978.

- 6. Laura Zittrain Eisenberg, “Do Good Fences Make Good Neighbors? Israel and Lebanon after the Withdrawal”, no. 4.

- 7. See “Exchange of notes constituting an Agreement respecting the boundary line between Syria and Palestine from the Mediterranean to El Hammé”, no. 4, p. 366.

- 8. “Position of Lebanon in preparation for the comprehensive assessment that will be presented by the Secretary-General in his forthcoming report on the implementation of Security Council resolution 1701 (2006)”, United Nations General Assembly, A/64/850–S/2010/344, 29 June 2010.

- 9. “The Maritime Boundaries and Natural Resources of the Republic of Lebanon”, United Nations Development Program, 27 February 2015.

- 10. Frederic C. Hof, “Parting the Seas”, New Lines Magazine, 4 December 2000.

- 11. “The Legal Framework of Lebanon’s Maritime Boundaries: The Exclusive Economic Zone and Offshore Hydrocarbon Resources”, Swiss Association for Euro-Arab-Muslim Dialogue, November 2012.

- 12. See “Agreement between the Government of the State of Israel and the Government of the Republic of Cyprus on the delimitation of the exclusive economic zone (with annexes)”, Nicosia, 17 December 2010, United Nations Treaty Series, Volume 2740, 2011.

- 13. “A letter dated 20 June 2011 from the Minister for Foreign Affairs and Emigrants of Lebanon addressed to the Secretary-General of the United Nations concerning the Agreement between the Government of the State of Israel and the Government of the Republic of Cyprus on the Delimitation of the Exclusive Economic Zone, signed in Nicosia on 17 December 2010”, United Nations.

- 14. Ibid.

- 15. “List of geographical coordinates for the delimitation of the Northern Limit of the Territorial Sea and Exclusive Economic Zone of the State of Israel in WGS84”, Permanent Mission of Israel to the United Nations, 10 July 2011.

- 16. Ali Taha, “Lebanon’s Southern Maritime Border Dispute: The Amendment of Decree No. 6433”, The Lebanese Center for Policy Studies, 19 May 2021. Decree 6433, which defined the country’s maritime boundaries with Israel based on Line 23, later became a point of contention after Lebanon revised the outer range of the boundaries as per Line 29.

- 17. “Assessment of undiscovered oil and gas resources of the Levant Basin Province, Eastern Mediterranean”, U.S. Geological Survey, Fact Sheet 2010-3014, March 2010.

- 18. “Communication dated 2 February 2017 from the Permanent Mission of Israel to the United Nations addressed to the office of the Secretary-General of the United Nations”, United Nations, 2 February 2017.

- 19. “Note Verbale dated 5 February 2020 from the Permanent Mission of Israel to the United Nations addressed to the Office of the Secretary-General”, United Nations.

- 20. Frederic C. Hof, “Parting the Seas”, no. 10.

- 21. Ali Taha, “Lebanon’s Southern Maritime Border Dispute: The Amendment of Decree No. 6433”, The Lebanese Center for Policy Studies, 19 May 2021.

- 22. Gary Lakes, “Lebanon Eyes Expansion of Disputed Maritime Area with Israel”, S&P Global Commodity Insights, 12 February 2021.

- 23. Mohamed O. Abd El-Aziz, “Will Lebanon and Israel Finally End their Maritime Border Dispute?”, The Cairo Review, 28 September 2022.

- 24. David Schenker, “Israel Falls for Lebanon’s Treaty Bait-and-Switch”, The Wall Street Journal, 11 October 2022.

- 25. Tovah Lazaroff and Anna Ahronheim, “If Nasrallah attacks Karish gas field, Lebanon will pay the price: Gantz”, The Jerusalem Post, 15 September 2022.

- 26. Bethan McKernan, “Israel risks crossing Hezbollah ‘red line’ as it prepares to connect to disputed gas field”, The Guardian, 20 September 2022.

- 27. Max Boot, “Biden just pulled off a big diplomatic victory–and almost no one noticed”, The Washington Post, 17 October 2022.

- 28. Bethan McKernan, “Israel and Lebanon Reach ‘Historic’ Maritime Border and Gas Fields Deal”, The Guardian, 11 October 2022.

- 29. “Full Text of the Maritime Border Deal Agreed between Israel and Lebanon”, The Times of Israel, 17 October 2022.

- 30. “Lebanon and Israel reach deal on maritime border”, The East Med Energy Report, Issue 11, 17 October 2022.

- 31. “Lebanon-Israel sea border deal a ‘good’ example for Cyprus: Türkiye”, The Daily Sabah, 28 October 2022.

- 32. Steven Scheer, “Energean starts gas production at Israel's Karish site”, Reuters, 26 October 2022; see also “Karish”, Energean.

- 33. “Report upgrades liquids volumes at Energean fields offshore Israel”, Offshore, 10 November 2020; see also “Significant 2P reserves increase at Energean’s Israeli Assets”, Energy Press, 10 November 2020.

- 34. “The government has approved the recommendations of the professional team for the periodic examination of the Zemach Committee’s conclusions”, Ministry of Energy, Israel, 10 January 2019.

- 35. “Karish”, Energean.

- 36. “Gas markets”, Ministry of Energy, Israel.

- 37. Elis Gjevori, “Israel sees gas exports to Europe boom in wake of Russian invasion of Ukraine”, Middle East Eye, 25 August 2022.

- 38. “Global energy crisis leads Israel to launching fourth natural gas exploration”, The Jerusalem Post, 30 May 2022.

- 39. “First-ever export of natural gas from Israel to the European Union”, Ministry of Energy, Israel, 15 June 2022.

- 40. Karolina Zielińska, “Israel’s Mediterranean gas: The potential for gas export to Europe and the dynamic of regional cooperation”, Center for Eastern Studies, 12 August 2022.

- 41. “Prime Minister Yair Lapid’s remarks from the press conference on the maritime agreement with Lebanon”, Prime Minister’s Office in Jerusalem, Israel, 12 October 2022.

- 42. “Lebanon's Hezbollah green-lights maritime border deal with Israel: Officials”, Reuters, 11 October 2022.

- 43. “Lebanon-Israel maritime border deal: What do we know?”, France 24, 14 October 2022.

- 44. Kareem Chehayeb and Abby Sewell, “Lebanon-Israel deal a landmark but with limits, experts say”, ABC News, 3 November 2022.

- 45. Carrie Keller-Lynn, “Netanyahu slams Lebanon deal as a ‘historic surrender’ to Hezbollah, Iran”, The Times of Israel, 12 October 2022.

- 46. “Netanyahu Pledges to ‘neutralize’ Israel-Lebanon Maritime Border Deal”, The Maritime Executive, 31 October 2022.

- 47. Ben Caspit, “Will Israel's Netanyahu upend Lebanon gas deal, Iran policy?”, Al-Monitor, 2 November 2022.