Enhancing Manufacturing Capability for Efficient Offsets Absorption

- January 2009 |

- Journal of Defence Studies

Since Independence, as a policy, Defence R&D in India had been reserved for the state sector with the DRDO having been established with the mandate to conduct research into Defence areas. Defence Public Sector Undertaking units (DPSUs) and Ordnance Factories (OFs) were set up with the twin objectives of:

- Productionisation of systems developed by DRDO;

- Produce defence goods under Transfer of Technology (ToT) from foreign suppliers and assimilate the technology.

This policy, when formulated, factored in the then state of private sector and also the fact that basic R&D in all nations need to be funded by the state. This resulted in investments, over the past decades, in infrastructure and facilities in Defence R&D and Defence Public Sector Undertakings, with the onus to work on technology and product development from the abstract stage to the productizing and hand holding at the production stage. DRDO did invite and involve a large number of industry partners within the limitations of prevalent procurement policies and did create few major success stories.

This model has served the nation to some extent. It can also be seen that little ToT actually happened from foreign technology sources in the cutting edge technology areas to the OFs and the DPSUs. These organizations did master the production skill sets, the ToT model for production denied development of upgrades and new systems. For a nation of one billion plus with arguably the best knowledge driven industry better than the best in the world, we ought to have done better. Need for the self reliance we seek cannot be emphasised more than the back of envelop calculation of the multiplier effect it will produce for the national economy through manufacturing growth rates and job creation. The only way ahead over next 10 to 15 years is to build focused product strategy with commensurate investments in Defence Industry across segments including private sector so that in the long term, the country meets its defence requirements as much as possible from within the country. This will only be possible by allowing the private sector to a play rightful role in product design, development, manufacturing and integration capabilities available in the private sector to augment the capacities built in the Public sector through Public–Private–Partnerships (PPP). The same, however, could not be harnessed proactively for the Defence Sector owing to the limitations of prevalent defence policy.

During the pre-liberalisation era, industrial activity was allowed only under license, and imports were controlled by the Director General Technology Development (DGTD) and a cap was put on the production capabilities. Government policies placed barriers on free trade and insulated the country from rapid technological advances. This resulted in stifling the economic and technological growth across sectors. The post liberalisation era, saw the removal of import restrictions, thus bringing in competition from the global players. Indian industry developed competitiveness despite the policy tilt in favour of imports of finished goods. Over the past decade and a half R&D in private sector came of age, Indian industry evolved and poised to become a global player in ICT, engineering and manufacturing. This was realized by the other strategic sectors (nuclear power and aerospace). They collaborated and synergised with private sector R&D for its nimbleness to achieve almost total self reliance in their needs thereby insulated the nation from all kind of sanctions. In the defence sector, however, the production remained reserved for the DPSUs / OFs. The ToT from OEMs was limited to manufacturing technologies. The result was that the nation remained a net importer of its security.

Even in the post liberalisation era, 1991 onwards, local sourcing was limited to component supplies, limited thrust was given to the private industry and “imports were not discouraged”. Realising the vast potential of the industry, the process of integrating the private sector in the defence industry was initiated by the Government in 2001. The policy decisions announced in May 2001 permitted 26 per cent FDI in the Defence industry and allowed the Indian private sector to participate in Defence production by obtaining a license. The Defence Procurement Procedure 2002 (DPP 2002) turned out to be the watershed for the Defence industry as it allowed the participation of the private industry in defence production in-principle. Kelkar Committee was constituted in 2004, to review private sector participation in defence production. Some of the recommendations made by the Committee have also been implemented through the Defence Procurement Procedures. These include constitution of selection committee for Raksha Udyog Ratnas (RUR), which are potential system integrators from the private sector, the very important offset policy common to both the public and the private sectors, and the Make Procedure. The aim was to enhance competitiveness of the industry with an aim to make them efficient, and achieve global benchmarks essential to compete in the global defence market. The subsequent DPP 2005, DPP 2006 and 2008 have incrementally over come some of those shortcomings and bridged the gaps in the promulgated policy. However, the policy intent is yet to be implemented fully as the nomination of the DPSUs / OFs still continues.

The Direct Offset policy applicable to all “Buy Global” RFPs valued at Rs 300 crores and above stipulated a minimum of 30 per cent of the cost of acquisition to be sourced from Indian defence industry. This policy aimed not only at ensuring the induction of advance technology in the industry but also bring in capital investment for the economic growth of the country.

Further, introduction of Offset Banking, announced in DPP-08, will not only facilitate the implementation of offsets with sunrise and sunset stipulations to enable foreign OEMs to demonstrate their intent for a long term engagement with the Indian Industry.

The foundation for the induction of technology, development of infrastructure and making investments attractive for the foreign OEMs is thus, in place.

Indian Industry: Capability

Indian industry has developed a strong industrial base with a successful track record of implementing technology intensive projects including bulk production within stipulated time frames at reasonable cost and world class quality. It has strengths in design, engineering, finance and marketing. It has a reservoir of management, scientific and technological skills. The growth in the manufacturing sector has been phenomenal and global standards have been reached in ICT, engineering and manufacturing. India is fast turning into a manufacturing hub for the world. Major MNCs have established their R&D and product development centres in India.

Even in defence sector there are large and small industry houses that have, over the years, built capabilities and capacities, through partnership with development agencies like DRDO, indigenisation cells in the services and DGQA. Many large industry houses have either built new capacities or carved out capacities within their own design and manufacturing capacities for defence sector.

Today private industry has the capability and the capacity to take up R&D / system integration projects under the following categories:

- Missile, rocket and torpedo launchers and fire control systems, both land mobile, and naval;

- Naval combat systems and platform management system;

- Naval engineering systems steering gears, stabilisers, landing grids, hanger shutters, traversing mechanism, boat davits;

- Platform specific machinery for ships, submarines, battle tanks;

- Ship design centre;

- Tank and gun upgrades;

- Other weapon systems and upgrades;

- Radar and towed Sonar;

- Rugged computers for ground and mobile applications;

- Air Defence command centres;

- Avionics and airborne systems;

- C4I2RS areas;

- Defence electronics;

Domain specific software development such as EW, Air Defence, RDP, MST, Fire Control / Ballistic Computer applications, etc.

Offset Policy and Offset Banking

The Offset Policy announced by the Government leverages bargaining power to get benefits to the country in the form of offsets to build its Defence Industry. This as per the current policy is direct and demands 30 per cent offsets on all Defence procurement above Rs.300 crores. The benefits are economic gains, skills development, technology gains, employment generation etc.

While looking at offsets, government seem to have stopped at making Indian Industry a part of global supply chain of defence majors and missed out at on the system domain. The consideration seems to be limiting to Transfer of Technology / Knowledge (Low Level). This is evident from the current taxes and duties treatment of offsets limiting offsets to supply of “parts and subsystems” sold by Indian industry through physical exports (being part of global supply chain) thus misses out on systems and system of systems integration within the country. Following needs to be looked into to make the offset policy more efficacious for the country:

- Offsets could also be supply of indigenous systems supplied as part of system of systems being sold by the foreign OEM and may directly be supplied to Indian services (not getting physically exported).

- It is also possible that offsets could be delivered by the foreign OEM in the form of system integration especially where large systems need to be fully integrated and tested in India. This involves passing on the system level know-how that is vital for building industry capability in doing so in India.

- Tax and Duty (T&D) implications in either of these cases add up to approximately 40 per cent of price accounting for the T&D on inputs as well as at point of sale. This effectively reduces offsets from 30 per cent to 21 per cent if delivered in India.

- To avoid this and facilitating indigenous capability building MoD may treat such system offsets at par with indigenous supplies to MoD or treat offsets either as “Import Substitution” or as “Deemed Exports” with use of corporate bonds and not involving physical payment of T&D upfront and get it reimbursed.

Capability to Absorb Offsets

The myth regarding capability of the Indian industry to absorb the huge quantum of defence offsets need to be looked at from the consideration of capability and non- capacity and track record. Let us examine if the offset volume is really large for the Indian industry? The capital defence purchases for this year are estimated at $10 billion and expected to reach $20 billion / year by end of 11th plan. Assuming that 50 per cent of this purchase would be from imports, and 60 per cent of that would qualify for offsets (less than Rs 300 crores), Offsets obligation at 30 per cent would mean volume of just about 9 per cent of the capital budget i.e. approximately $1- $2 billion per year.

Indian manufacturing industry has come of age and is growing steadily at the rate of 25 per cent year-on-year since 2001. The manufacturing sector has shown enormous potential for growth. There is a healthy FDI flowing in to further bolster this growth. Thus absorbing approximately $2 billion per year of offset volume is not an issue at all for the Indian industry.

Manufacturing Strength

India is undergoing structural transformation with manufacturing increasing its role in the Indian economy. Manufacturing now accounts for about a 27 per cent of India’s GDP and contributes 53 per cent of total exports, 79 per cent of FDI and employs 11 per cent of the workforce. India’s competitive advantages offer huge opportunities for exports especially in areas like automotives and electronics.

According to a study by the Boston Consulting Group, India’s vast domestic market and relatively low-cost workers with advanced technical skills will make it a manufacturing powerhouse within the next 5-10 years. Accordingly, multinationals have already started setting up operations in India to operate in skill-intensive industry segments requiring advanced technical expertise, areas in which India is becoming a primary sourcing and manufacturing base. In fact, high skill sectors account for almost 40 per cent of the manufacturing output of India.

The strong manufacturing base coupled with the well-established IT industry would be able to comfortably absorb offset related investments in their respective sectors. Given below is some further information on the manufacturing sector which indicates the ability of the local industry to absorb substantial amount of offsets. India is the second largest small car market in the world; it is one of the three countries that make their own super-computers and has the second largest mobile phone market.

The Export Story

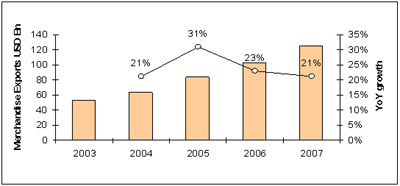

India’s export target for the year 2008-09 is $200 billion. India has had a sustained year-on-year growth of approximately 25 per cent year-o-year for the past four years.

Source: Ministry of Commerce, Government of India.

India has not yet begun to tap its manufacturing export potential fully, ‘Made in India’ could become the next big manufacturing export story with its “Frugal” engineering capability.

According to Mckinsey Report, if India were to take advantage of global low cost country manufacturing trend, manufactured goods exports from India could increase from $40 billion in 2002** to approximately $300 billion by 2015, leading to a share of approximately 3.5 per cent of the world trade in manufactured projects. This is likely to create 25-30 million new jobs in manufacturing and add 1 per cent to India’s annual GDP growth rate.

Attractiveness of India as a manufacturing destination

Figure 2

Manufacturing sector in India

Following sectors contribute 60-70 per cent to export:

- Auto industry: The Indian auto industry is a $44 billion industry (Automotives is a $34 billion industry and Auto components are $10 billion).

- Chemicals: The size of the chemical industry in India (petrochemicals to paints) is $30 billion.

- Electronics: The electronics industry is a $11 billion (consumer electronics to electronic components) industry.

- Engineering: A $22 billion industry including heavy and light engineering.

- Machine Tools: Industry size is $225 million.

- Textiles: Industry size is $38 billion.

The balance 30-40 per cent exports are from sectors like automotive, cement, food processing, drugs and pharmaceuticals, telecom equipment, IT hardware, electronics, paper, minerals and metals

Indian manufacturing is forecasted to grow at 12-14 per cent over the next decade and sectors like automotive, electronics etc. are expected to be growth drivers.

Manufacturing – A Perspective

Joint Ventures: The Indian defence industry lags far behind the global defence industry. The capability of Private sector that was introduced to defence sector only after opening up of the defence sector, is in a nascent stage (with some exceptions). The offset policy introduced in the year 2006 can transform the threshold level of Indian defence industry. Perspective joint ventures precisely help do that task when used as a tool to support the offsets.

The joint ventures partnerships between industries envisage cooperation and co-working by sharing each other’s expertise, experience and resources leading to development and further selling of a product globally. Such partnerships can be cross border, across sectors, range, and based on a win–win model to evolve new products, improve existing products, raise the technology threshold, improve skills as well as cater to in service-life support.

Joint Ventures for Indian Defence Industry

The joint ventures and co-production are one of the very effective ways to improve the capabilities of Indian defence industry. The performance of Indian defence industry primarily meant to support the Indian defence forces under the “protective environment” has been sub optimal as is evident from the statistics below.

Breakdown of the revenue of OFs and DPSUs and their share in defence capital expenditure:

| Year | Ofs | DPSUs | Total | % of capex |

|---|---|---|---|---|

| 2003-04 | 6,523.87 | 9,892.73 | 16,416.60 | 78 |

| 2004-05 | 6,186.65 | 11,248.59 | 17,435.14 | 52 |

| 2005-06 | 6,891.68 | 13,025.07 | 19,916.74 | 58 |

| Note: Figures in INR crores;

Source: Ministry of Defence, GOI. |

India’s defence industry in private sector is in a transition stage, where the effects of the policy changes are yet to materialize. There is thus a need to boost the local defence industry involving both public and private sector through the route of joint ventures facilitated by the Offset Policy through appropriate incentives. This will not only help get the technology and work ethics, but also expose the local industry to the global supply chains and bring in domain knowledge in system integration.

Potential Areas for Joint Ventures in Indian Defence Industry

Defence industry is not restricted to a particular sector, and spreads across complete range of goods and products involving land systems, aviation, marine, arms and ammunition, IT and communication, missile, general stores, to name a few. There will be need to define the priority areas and match them with the existing and potential capability of Indian Defence industry for achieving optimum benefits by Joint Ventures.

Methodology

While Joint Ventures need to be discussed on case to case basis, the following are recommended:

- Define the objective of Joint Venture i.e. upgrade the Indian defence industry.

- Joint Ventures and Long term partnerships are preferred over project to project relationship and other options in offsets.

- All projects for Joint Ventures should be pre approved by DOFA.

- Need to insist on Joint Ventures with production facilities in India and involving domain expertise.

- Monitoring of projects is done by DOFA and credits be banked on yearly basis – based on the progress.

- Rule of 26 per cent FDI cap should be dovetailed with country’s need and level of domain expertise brought in.

- Both private and public sector should be allowed – the foreign partner should have the liberty to pick up the partner as per current offset policy.

- Government should monitor the Joint Ventures and benefits that accrue out of them.

Joint Ventures are a means to upgrade the local industry. They should be given priority in offsets for the benefit of Indian defence industry.

Offsets Implementation: Taxes and Duties

- Customs Duty on imports:

- Excise Duty:

- Sales tax / VAT:

Currently the Offset Partner needs to pay applicable customs duty (CD) and countervailing duty (CVD equivalent to excise duty) on the imports that are needed by Offset Partner. At present, for the Defence related contracts placed directly on Indian suppliers, Indian suppliers are provided with customs duty (including CVD) exemption certificate for their imports.

Further, the Customs duty (as also CVD) is exempted for Defence supplies from Foreign OEM when ordered directly by MOD. A similar treatment need to be given to Indian Offset Partners of foreign OEMs.

Deliverables by Offset Partner needs to pay prevalent excise duty (14.42 per cent at present) on their deliverables as well as local input materials. This is at variance with the rest of the specified category Defence systems (for deliverables), when excise duty exemption is granted for the deliverables by Indian supplier to MOD/DRDO etc. Equivalent excise duty (CVD) is also not applied on the deliverables by foreign supplier, directly to MOD, as CVD is also exempted along with the CD.

There is a case for treating “Indigenous value additions” for indigenous sales either in the form of system integration or systems as part of system of systems supplied by foreign OEMs as “Import Substitution” and treated on par with imports.

Contract for offset is going to be placed by foreign supplier on Indian Offset Partner. Therefore, deliverables are sold from Offset Partner to Foreign supplier. Hence sales tax / VAT (12.5 per cent) becomes payable on deliverables by Offset Partner.

There is a case for treating “Indigenous value additions” for Indigenous sales either in the form of system integration or systems as part of system of systems supplied by foreign OEMs as “Import Substitution” and treated on par with imports.

Both the above scenarios would not be the intentions of the “Offset Policy” and are certainly not favourable to Offset Partners looking at large value addition.

| Attachment |

|---|

Download Complete [PDF] Download Complete [PDF] |