Russia’s Arctic LNG: A Potential Alternative for India’s Energy Security

- April 29, 2025 |

- Issue Brief

Summary

India’s limited domestic gas production capabilities and its projected rising future demands of LNG necessitates not only an increase in gas supplies from traditional suppliers but also to seek new and secure long-term alternatives.

Introduction

The International Energy Agency (IEA) in a recent assessment has highlighted that India’s demands for Liquified Natural Gas (LNG) are set to reach 103 billion cubic meters (BCM) annually, by the end of this decade.[1] Rapid infrastructure expansion, increase in domestic manufacturing and production, clear government policy guidelines and an expected easing in the global gas markets have been highlighted as some of the key reasons that could account for the increased demand for natural gas. India’s limited domestic gas production capabilities and its projected rising future demands of LNG necessitates not only increase in gas supplies from its traditional suppliers, but also to seek new and secure long-term alternatives. Projects in the Russian Arctic offer India strategic alternatives for the consistent supply of LNG.

LNG Scenario in India

In 2023, India’s domestic gas production catered for just 50 per cent of the country’s total natural gas requirements. The projected growth in country’s domestic production is expected to reach around just 38 bcm by 2030. Since 2019, the number of compressed natural gas (CNG) stations in India has increased by four times and the number of domestic household gas connections has almost doubled the existing number. By 2030, India aims have around 17,500 CNG stations and approximately 120 million Piped Natural Gas (PNG) connections, nearly double to current capacities.[2] As a result of the government’s clear focus on expanding the gas distribution network in the country, the gas transmission pipeline network in India has grown by 40 per cent. Further, it needs to be highlighted that natural gas currently accounts for about just 6.7 per cent share in India’s energy basket.

The government has emphasised that transforming India into a gas-based economy is a priority. In order to achieve this goal, the government in the past has already set a target to raise the share of natural gas in India’s total energy mix from 6.7 per cent to 15 per cent by 2030.[3] Therefore, in a scenario where domestic production of LNG is far less than the projected future needs, there is an urgency to secure long-term LNG contracts and also find reliable diversified sources of imports that can cater to India’s future requirements. This will reduce India’s potential exposure to spot market price volatility of LNG, limit geopolitical risks and would enable country’s long-term energy security.

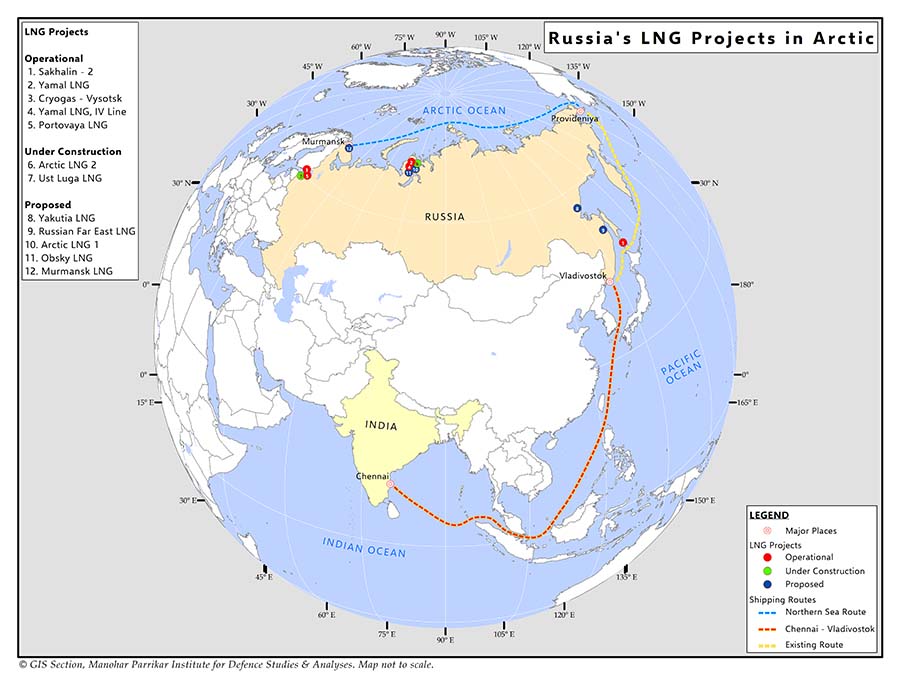

Russian LNG projects in Arctic

Development of large-scale LNG projects has been on Russian state’s priority agenda since 2000.[4] This is reflected in Russian strategy documents on the Arctic that call for the need to develop and harness the economic potential of Russian Arctic LNG for national development.[5] Major Russian Arctic LNG projects includes the Yamal LNG, located in Sabetta in the north-east of the Yamal Peninsula; Kryogaz-Vysotsk and Portovaya projects located on the shores of the Baltic Sea near Finland, Sakhalin 1 & 2 located in the Russian Far East; and the Arctic LNG-2 project located on Russia’s Gydan Peninsula. Of these, Yamal and Sakhalin 1 & 2 projects continue to remain functional, whereas production and supply chains from Vyotsk, Portovaya and Arctic LNG-2 has been impacted as a result of Western sanctions.

Russia’s Arctic LNG-2 project has been hit with Western sanctions since Russia’s military operation in Ukraine. These sanctions have significantly hindered the progress of the project by restricting Russia’s access to critical technologies and LNG tankers for its transportation. The extent of Western sanctions on Russia’s Arctic LNG-2 is so comprehensive that these have also restricted foreign shipyards from constructing and supplying new LNG carrier ships needed to transport Russian LNG from this project.[6]

Further, Western sanctions remain in force in terms of payments, insurances, third party companies and individuals dealing with this project to inflict maximum damages. Novatek, which accounts for 60 per cent stake in Arctic LNG-2, started production at Arctic LNG- 2’s first train in December 2023, but it could not last long due to shortages of ice-class gas carriers and the sanctions. Despite these odds, production/test-production at Arctic LNG-2 has now re-started and Chinese companies are at the forefront in providing critical components required for starting the production.[7] Once operational, the Arctic LNG -2 is expected to have an eventual output of 19.8 million metric tons per year.[8]

Russian LNG Production: Future Projections

Ongoing challenges of the Ukraine–Russia conflict have hampered the pace of development of new Russian LNG projects. Despite this, long-term planning of the Russian state in the exploration and exploitation of LNG remains intact. Russian Deputy Prime Minister Alexander Novak in 2024 highlighted that country aimed to increase LNG production from its current capacity of 33 million tonnes to 100 million tonnes by 2035.[9] He argued that this increase would be witnessed throughout the LNG clusters where he emphasised that the Yamal cluster would see an expected production growth from 20 million tonnes to 60 million tonnes of LNG per year; an increase from 2.2 million tonnes to 15 million tonnes in Baltic cluster and this growth is expected to reach from 11 million tonnes to 15 million tonnes in Sakhalin clusters.

Novak further highlighted that there are also plans to build new LNG clusters in the Murmansk Region that would potentially add an additional 20 million tonnes of LNG capacity per year to Russia’s total production.[10] Russian experts believe that if this trend continues, Russia could potentially capture 20 per cent to 25 per cent of the global LNG market by 2035, by adapting and mitigating even the impacts of short-term sanctions and energy competition from other market players.[11]

Figure 1. Russia’s LNG Projects in Arctic

Source: GIS Section, Manohar Parrikar Institute for Defence Studies and Analyses, Delhi.

Opportunities for India

India primarily imports LNG from Qatar, the US and the United Arab Emirates (UAE). Qatar remains the largest supplier and accounts for more than 50 per cent of India’s LNG needs. This is followed by the US, which in 2024 surpassed the UAE to become India’s second-largest source of super-chilled gas. Estimates suggest that between January and November 2024, India’s LNG imports from Qatar accounted for 9.82 million tonnes, followed by 5.12 million tonnes of imports from the US.[12] As India’s projected LNG demands are expected to significantly rise in the future, there is a need to diversify India’s sources of imports of LNG. This diversification remains essential not only in terms of sources, but also in terms of geographical locations and supply routes.

Russia, which is India’s crucial partner in terms of meeting the country’s oil requirement, could become an important strategic alternative to India’s rising LNG needs. At this crucial juncture when some of Russia’s LNG projects are in nascent stage of development and are striving to secure long-term investments from reliable partners, an excellent opportunity exists for India to invest. These would not only enable Indian companies a long-term solution to fulfill India’s growing LNG needs, but could also enable Indian energy companies to earn proportional profits by jointly selling Russian LNG to other states in Asia and globally.

Second, the European Union and other Asian allies such as Japan, despite Western sanctions, continue to buy Russian LNG. Some of these states’ gas consortium companies continue to remain invested in Russian LNG projects.[13] EU member states themselves in 2024 purchased a total of worth €7 billion of Russian LNG to meet their energy demands. Estimates suggest that LNG deliveries from Russia to EU in 2024 grew by 18 per cent as compared to the previous year’s import figures data. Of the total purchases of 2024, France, Belgium and Spain accounted for 85 per cent of Russian LNG imports.[14] Similarly, despite strong pressure from the West, a consortium of Japanese energy companies continue to remain invested and import LNG from Russia’s Sakhalin-2 project. Japan’s Industry Minister Yoji Muto has recently emphasised that “Japan will take all possible measures to prevent disruptions in securing a stable supply of liquefied natural gas from Russia’s Sakhalin-2”.[15]

Indian gas companies, therefore, need to consider venturing into long-term LNG procurement deals with Russian LNG companies, at times when Russia companies have limited order books and are in dire need of credible long-term purchase partners. During the India Energy week in February 2025, Russia’s Novatek showed interest and called upon Indian Energy companies to consider Arctic LNG-2 for meeting India’s future energy needs.[16] Any attempt from the West to undermine India’s energy interests, through sanctions or any kind of external pressure, needs a proactive strategy for which the Government of India already remains pragmatic and proactive in its approach. India’s Petroleum and Natural Gas Minister Hardeep Singh Puri recently emphasised that on the aspect of energy, India remains “open for cooperation with all countries in the world”.[17]

Third, Russian LNG projects in the Arctic (especially Arctic LNG-2) remain severely impacted as a result of shortage of LNG-carriers. Limitations of Russia’s own shipbuilding yards as a result of technological sanctions along with the freezing of the delivery of some of Russia’s new LNG carriers under construction at South Korean Shipyards, has caused great challenges for Russian companies to fulfill existing orders. Due to Russia’s struggling domestic shipbuilding industry, Russian state-owned company, Rosatom in the 2024 reached out to Indian shipbuilding companies for the construction of four non-nuclear icebreaker ships. In order to further strength India–Russia cooperation in shipbuilding, both countries during Prime Minister Narendra Modi’s visit to Moscow in 2024, expressed their readiness to establish a joint working body within the ‘India-Russia Inter-governmental Commission on Trade, Economic, Scientific, Technological and Cultural Cooperation (IRIGC-TEC)’ so as to facilitate cooperation on shipbuilding between the two countries.[18]

Increased LNG supplies from Russia in future would potentially increase Russia’s demand for new small, large and medium LNG carriers. This offers potential prospects for new business opportunities for Indian shipping, shipbuilding and ship repair companies. Indian companies need to consolidate all such emerging opportunities which will resonate well with India’s ‘Maritime Amrit Kaal Vision 2047’ that calls for uplifting Indian shipbuilding industry, port infrastructure, Blue Economy and all other related maritime sectors.[19]

Fourth, India’s venture into either direct investment opportunity in Russian Arctic LNG-2 or in Sakhalin LNG project or even entering into long-term purchase agreement with Russia, would result in increase in LNG cargo transfer via Russia’s Northern Sea Route (NSR) and further through Chennai–Vladivostok route. This, for India, would enable increase in shipping traffic on these routes and ultimately on India’s Eastern ports, thereby enabling greater economic activity and industrial development.

Fifth, from the strategic perspective, India’s LNG shipments, transiting initially through the sections of NSR and further through Eastern Chennai–Vladivostok shipping route for their final destination to India and other Asian ports, would have greater stability and security from traditional threats existing on shipping routes and narrow choke points in the Western Indian Ocean Region. This would enhance safety and security to India’s future energy cargoes.

Conclusion

If India–Russia bilateral trade needs to reach/cross the set target of US$ 100 billion by 2030,[20] there is a need to find new avenues for expanding bilateral cooperation. Investments and new trade opportunities in Russia’s LNG projects in the Arctic offer promising prospects. Though Western sanctions post-Ukraine have significantly hampered the ongoing developments in these LNG projects, Russian LNG companies remain optimistic and interested in seeking long-term partnerships with Indian counterparts. While Western sanctions persist, EU member states themselves continue to buy Russian LNG in bulk quantities and at favourable prices to meet their energy security requirements. In 2024, EU member states imported around 16.65 m tonnes of LNG from Russia, which surpassed the total recorded estimates of 15.21 m tonnes and 15.18 m tonnes of 2022 and 2023 respectively.[21]

There are emerging re-alignments in global trade framework in the aftermath of the Trump administration coming to power in Washington. Assessments also suggest that in negotiations between the US and Russia over Ukraine, discussions on lifting sanctions from Russian LNG could be expected to be part of the deal. The US, which itself wants to develop its LNG in Alaskan Arctic and seeks investments from Asian states, still has a long way to go before reaching its desired production levels and to supply LNG to Asian markets at competitive prices.[22] Therefore, in such a scenario, Indian energy companies and policy experts need to re-configure India’s existing options beforehand to ensure country’s long-term energy security. Venturing into these projects of course needs to be finalised by duly analysing the future projections of LNGs global production and demand, spot market prices and broader assessments of other geopolitical factors.

Views expressed are of the author and do not necessarily reflect the views of the Manohar Parrikar IDSA or of the Government of India.

[1] “India’s Natural Gas Demand Set for 60% Rise by 2030, Supported by Upcoming Global LNG Supply Wave”, International Energy Agency (IEA), 12 February 2025.

[2] Saurav Anand, “India to Boost CNG, PNG Infrastructure with 17,500 Stations, 120 Million Connections by 2030: Puri”, ET Energy World, 6 March 2024.

[3] “Share of Natural Gas in Total Energy Mix”, Press Information Bureau, Ministry of Petroleum & Natural Gas, Government of India, 18 December 2023.

[4] “Russia will Increase its Share in the LNG Market, Putin Said”, RIA Novosti, 19 December 2024.

[5] Nazrin Mehdiyeva, “Strategy of Development of the Arctic Zone of the Russian Federation and the Provision of National Security for the Period to 2035”, NATO Defence College, 25 June 2021.

[6] Filip Rudnik, “Russia: Arctic LNG 2’s Capacity is Reduced Due to Sanctions”, Centre for Eastern Studies (OSW), 26 April 2024.

[7] Malte Humpert, “Russia Continues Working on Sanctioned Arctic LNG 2 With Wison Power Modules Installation and Gas Flaring”, High North News, 3 April 2025.

[8] “Russia’s Arctic LNG 2 Plant Resumes Operation ‘Slowly’”, Reuters, 1 April 2025.

[9] “Plans to Construct LNG Plant as Part of Sakhalin-1 Remain – Novak”, Interfax, 20 February 2024.

[10] Ibid.

[11] Sergey Sukhankin, “Russia Navigates Challenges to Achieve Optimistic Post-2035 LNG Strategy”, The Jamestown Foundation, 24 February 2025.

[12] Sukalp Sharma, “As India and Qatar Eye Trade Expansion, why LNG’s Centrality in Bilateral Trade is in Focus”, Indian Express, 21 February 2025.

[13] America Hernandez, “Total Energies CEO Says up to $2 billion Stuck in Russia”, Reuters, 31 October 2024.

[14] Malte Humpert, “EU Countries Spent Close to €7bn on Russian LNG in 2024”, High North News, 18 February 2025.

[15] Yuka Obayashi, “Japan to Take All Steps to Ensure Uninterrupted Sakhalin-2 LNG Supply from Russia”, Reuters, 22 November 2024.

[16] Malte Humpert, “Russia’s Novatek Eyes India as Market for Sanctioned Arctic LNG”, High North News, 17 February 2025.

[17] Ryosuke Hanafusa, “India Won’t Rule Out Buying Russian LNG if Price is Right: Oil Minister”, Nikkei Asia, 3 November 2024.

[18] Shubhangi Palve, “Russia Selects India Over China To Construct Its ‘Cutting-Edge’ Icebreaker Ships; But Why Delhi Over Beijing?”, The Asian Times, 11 October 2024.

[19] “Maritime Amrit Kaal Vision 2047”, Ministry of Ports, Shipping and Waterways, Government of India, October 2023.

[20] Amiti Sen, “Modi, Putin Set Bilateral Trade Target of $100 billion by 2030”, Business Line, 10 July 2024.

[21] Malte Humpert, “EU Imports More Russian LNG in 2024 Than Ever Before, Mostly From Arctic”, High North News, 6 January 2025.

[22] Katya Golubkova, Yuka Obayashi and Tim Kelly, “Alaskan Officials To Seek Investors in Japan as Trump Touts LNG”, Reuters, 17 March 2025.